There can be a situation during any course of life when you need your loved ones to step in your shoes. These situations may include any health issue, disability, expiration, or simply your absence. You need someone trustworthy to make decisions on your behalf. But it is only possible when you define the roles through a readable power of attorney (POA).

A POA document can allow your trusted personnel to make financial and legal decisions when you are away. You can appoint any individual by using the power of attorney form.

What Is a Power of Attorney Form?

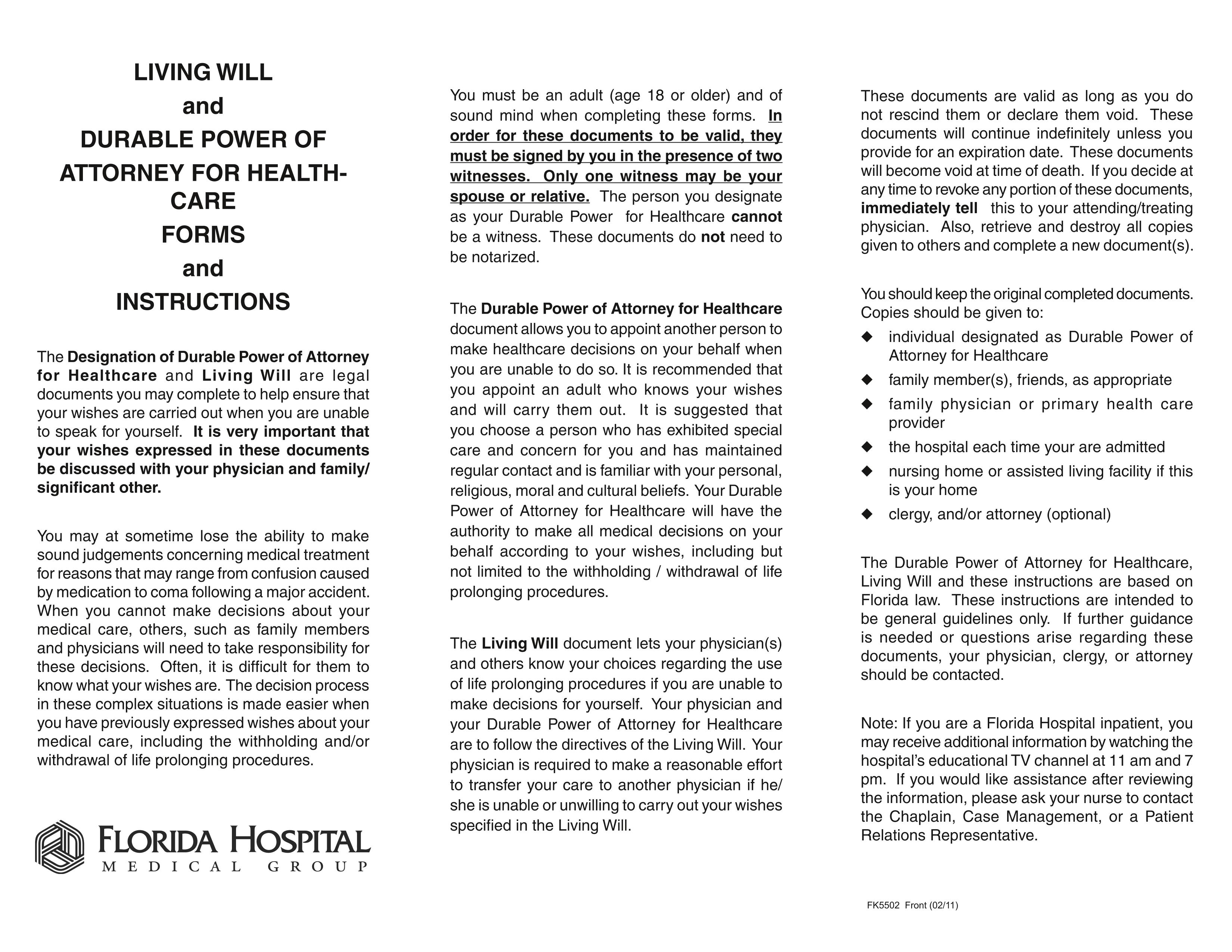

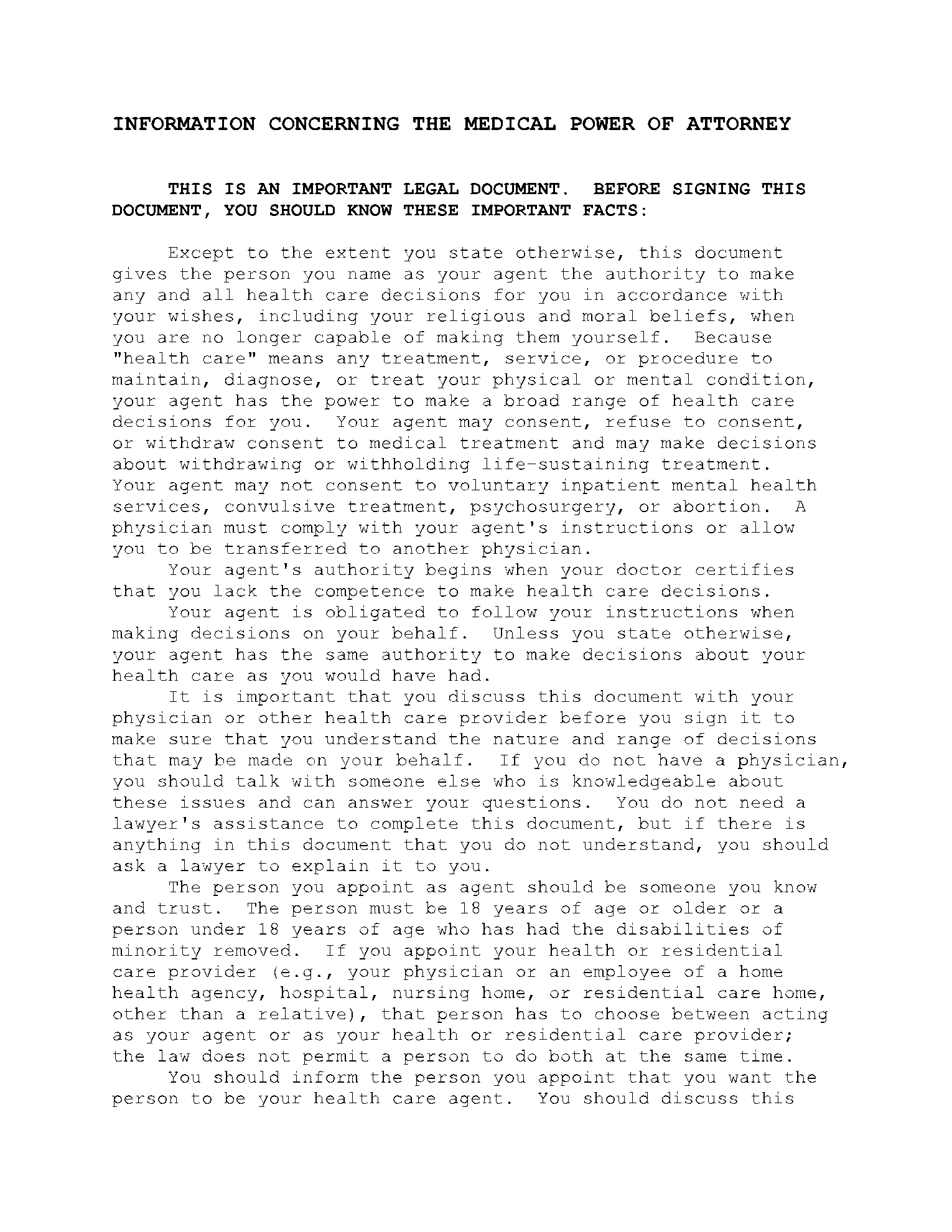

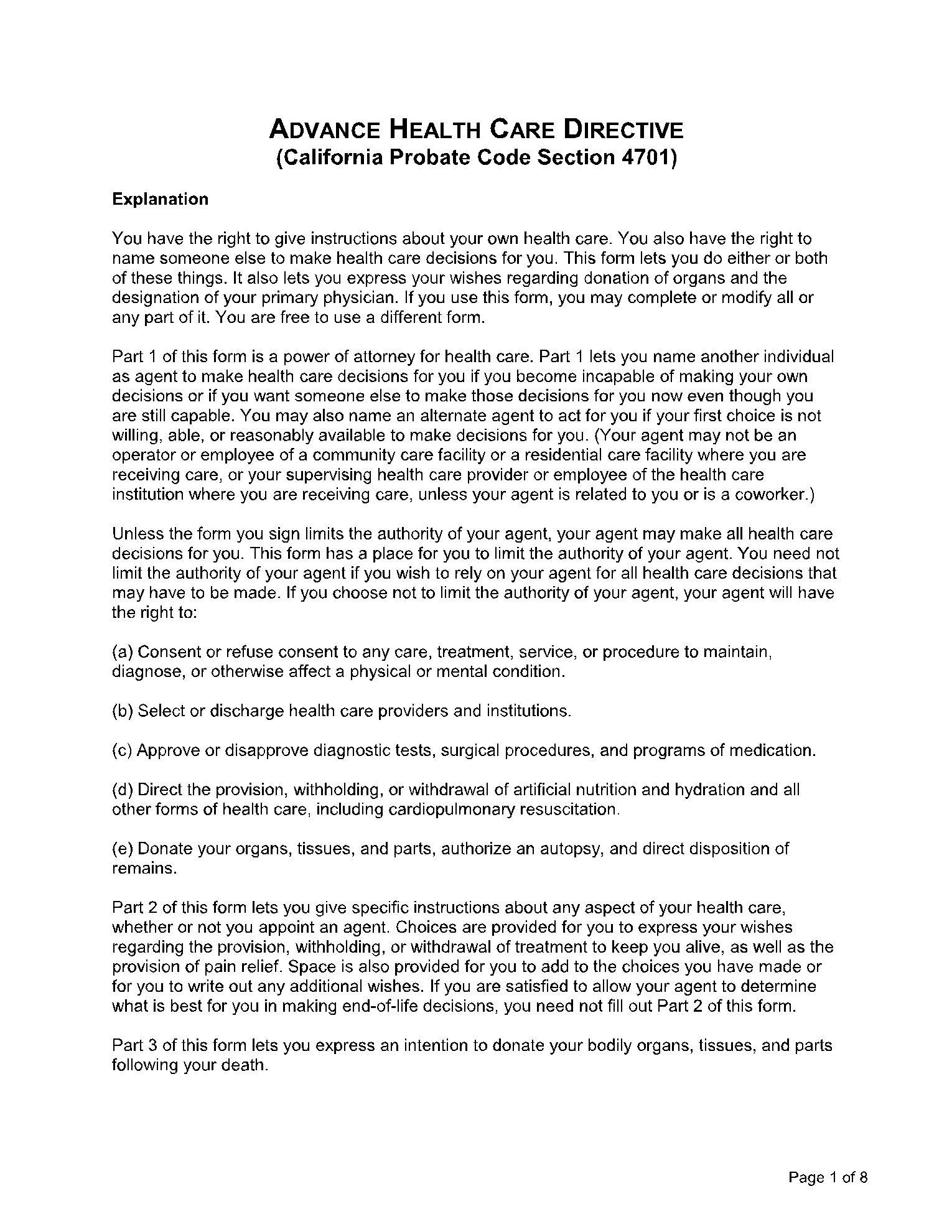

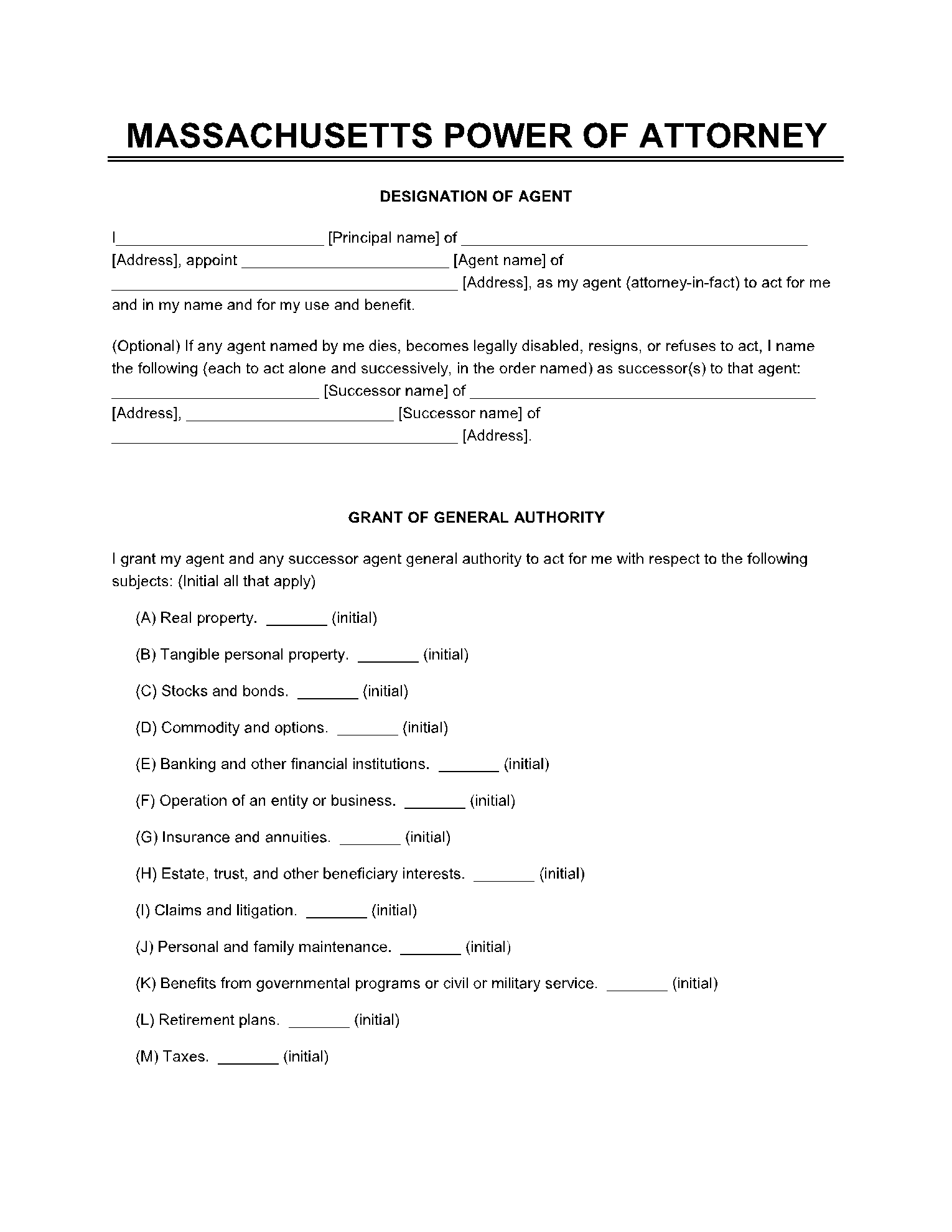

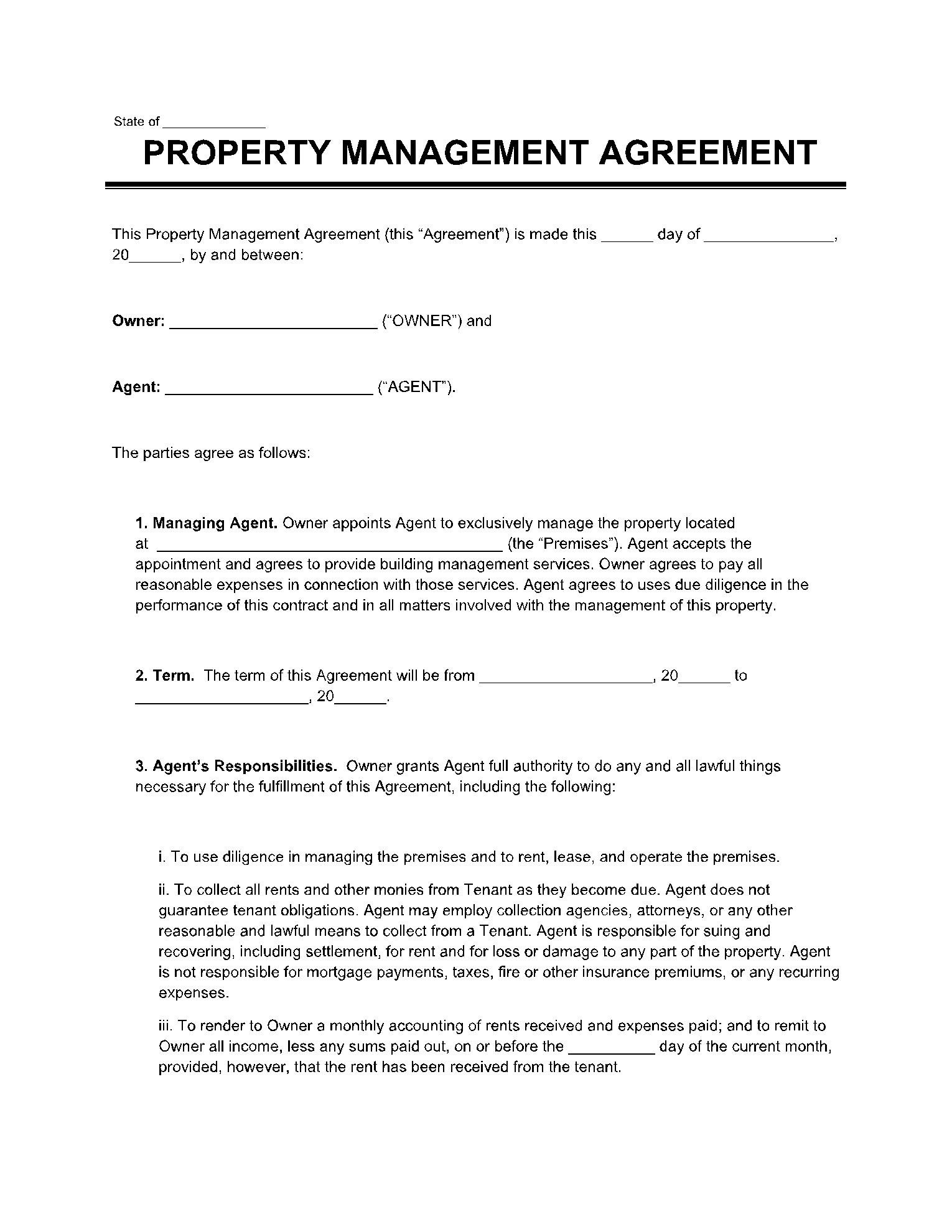

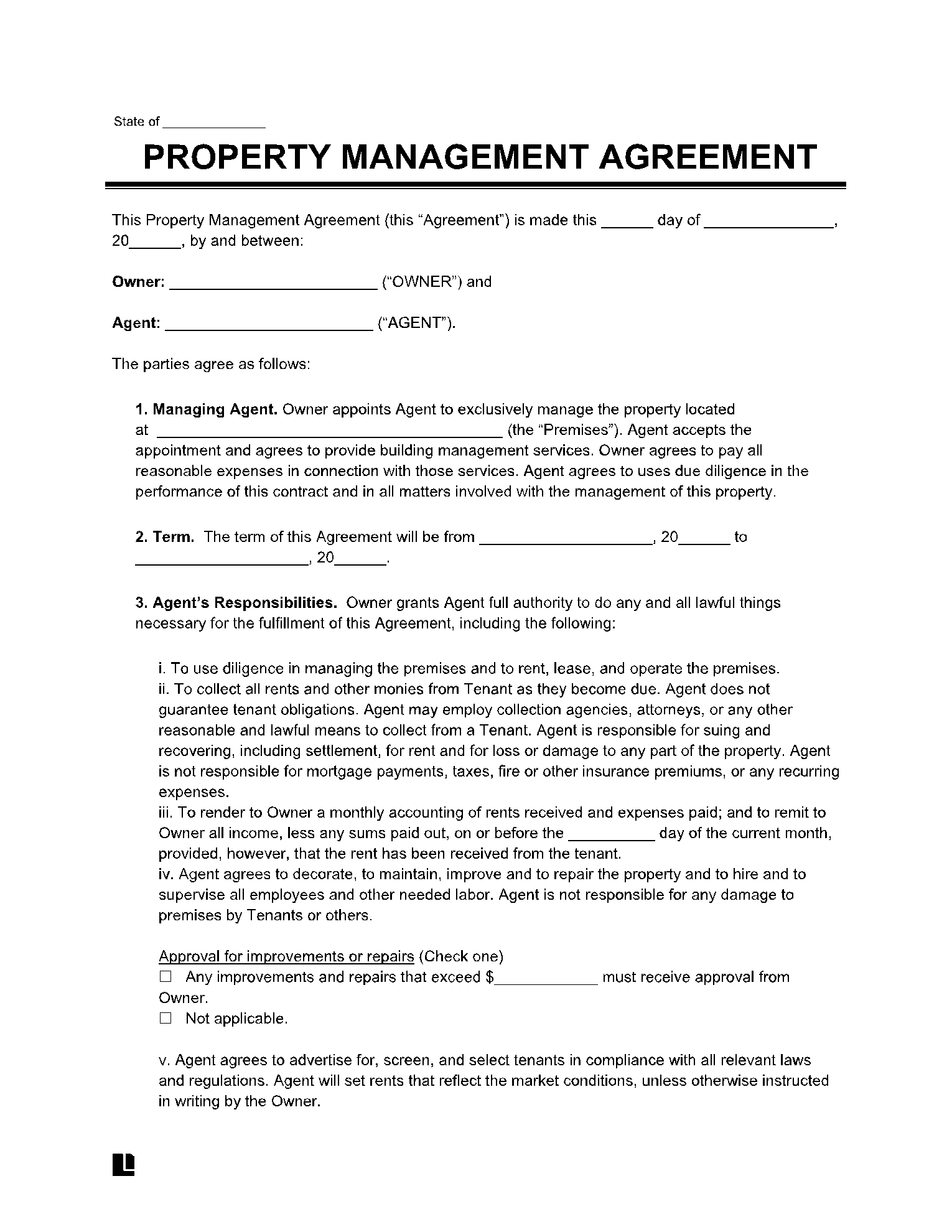

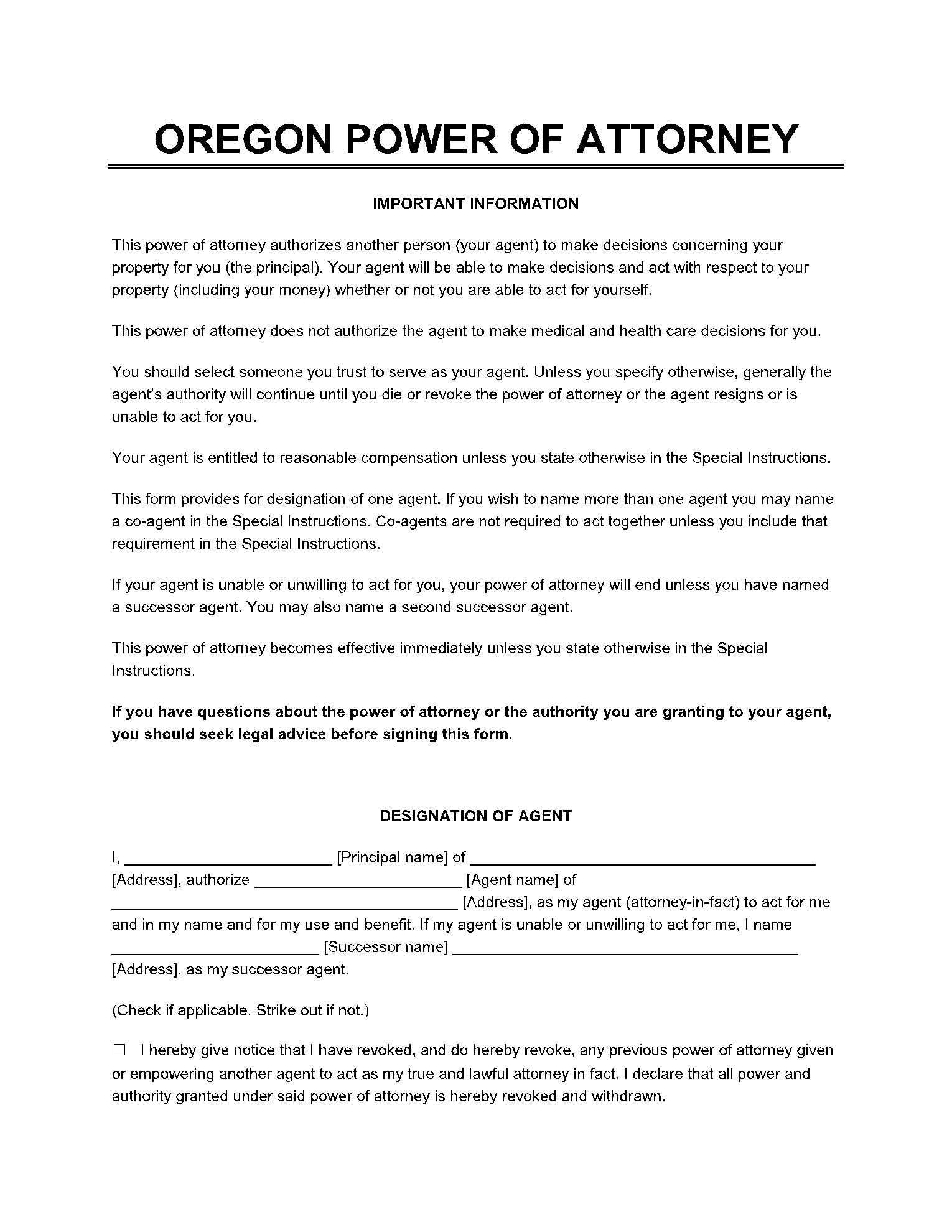

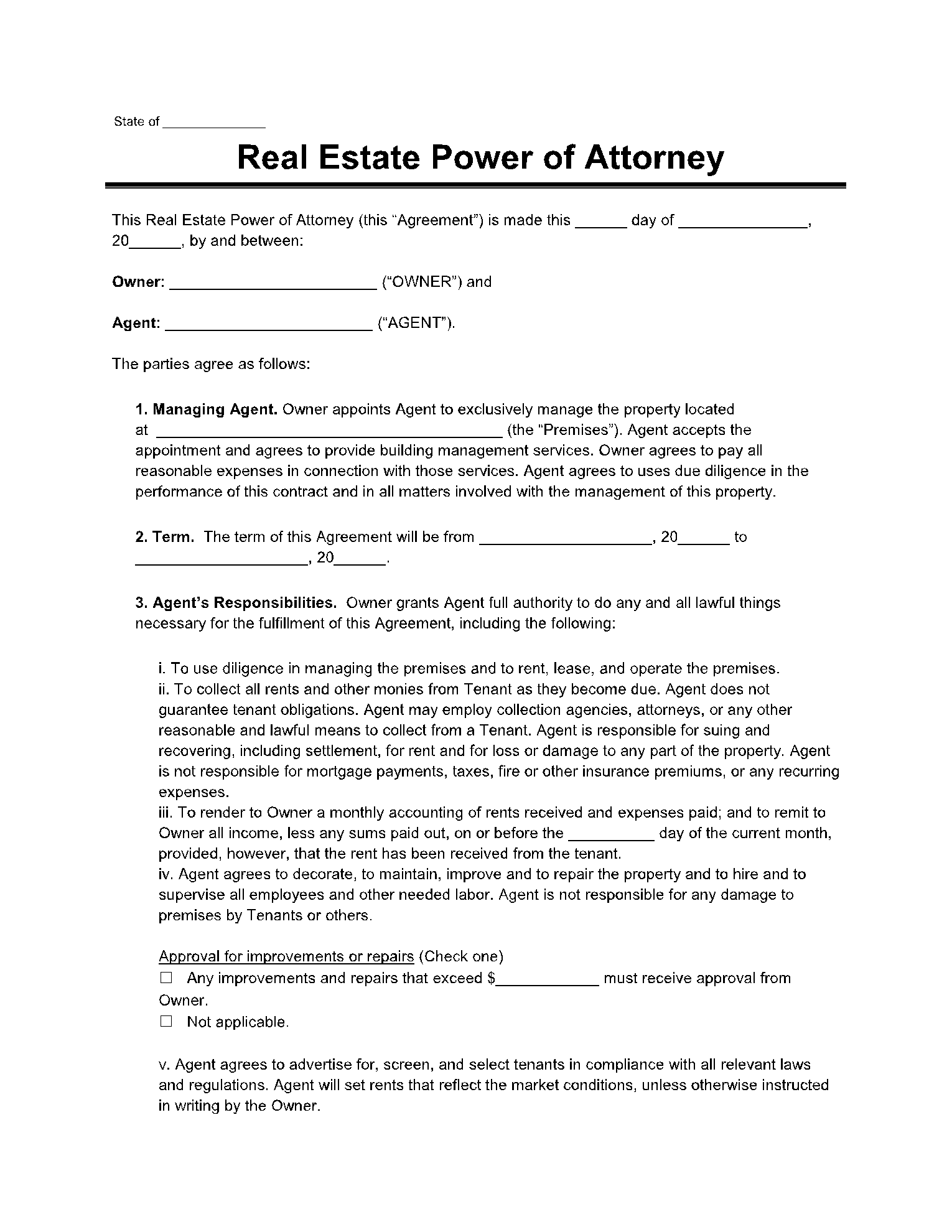

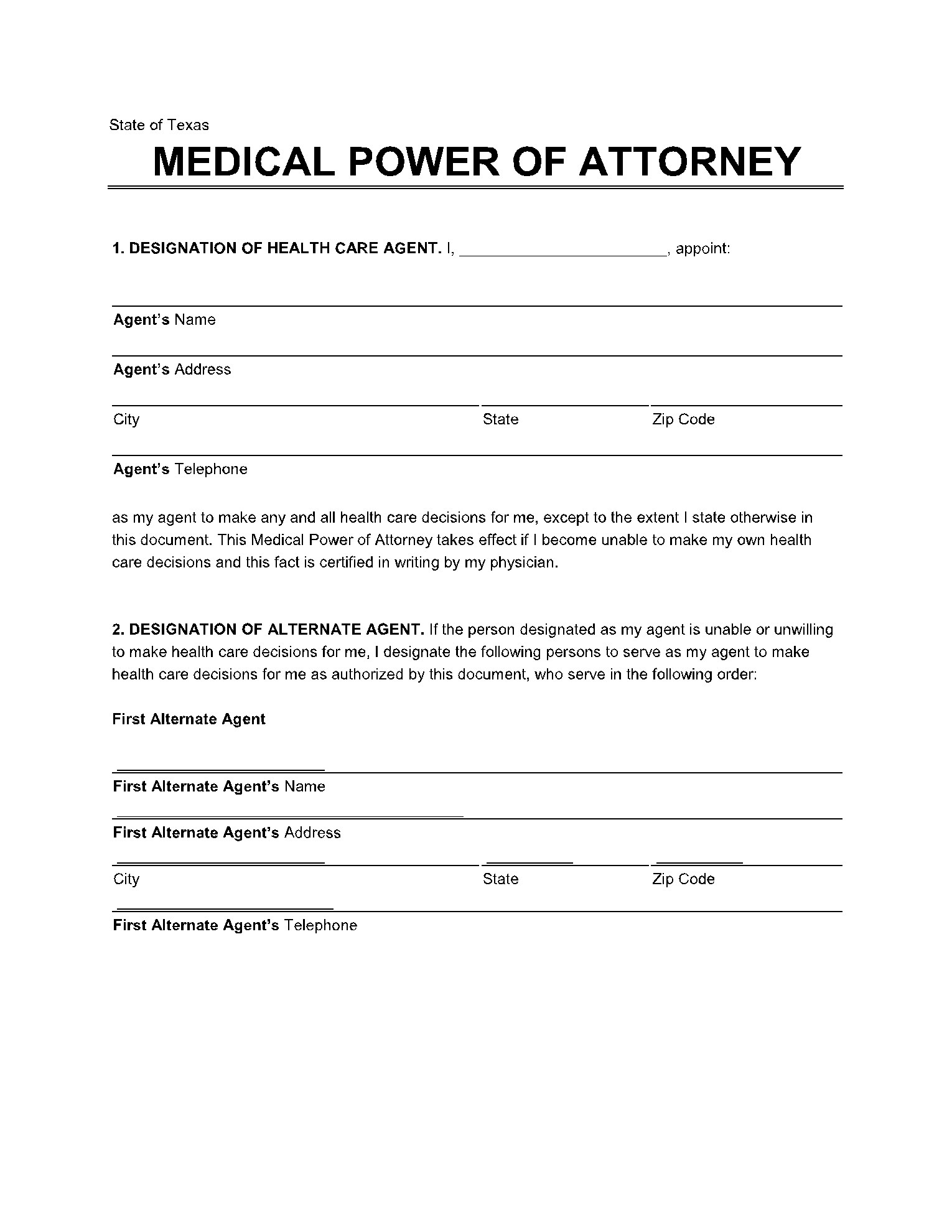

A power of attorney form authorized a person to make decisions on behalf of another person if that person is unable to do so themselves. This individual can be a member of your family or a friend. It can also be fiduciaries, such as your accountants, lawyers, and people from other firms. It will grant the power to control business and financial transactions, health-care decisions, buying or selling of land, or simply to take care of the family.

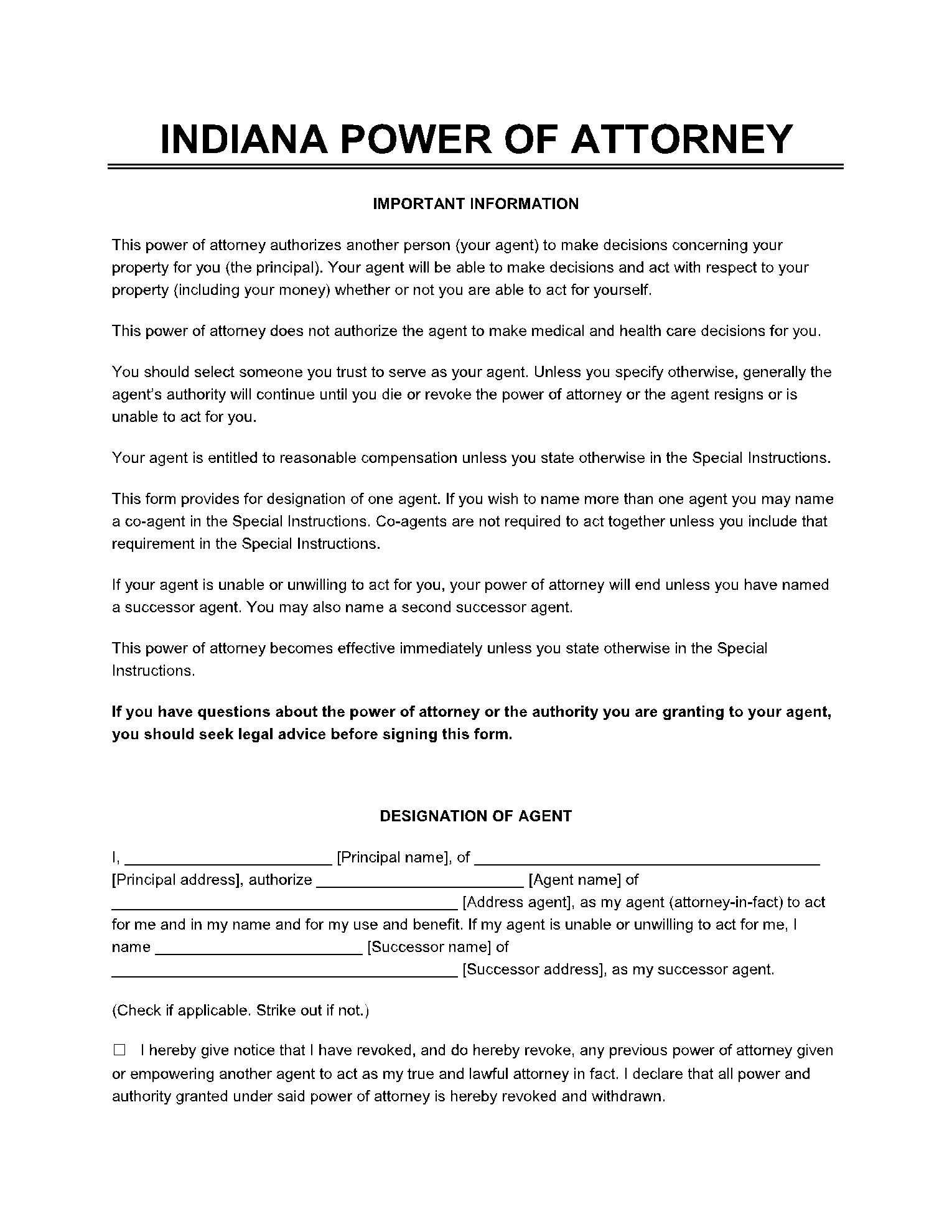

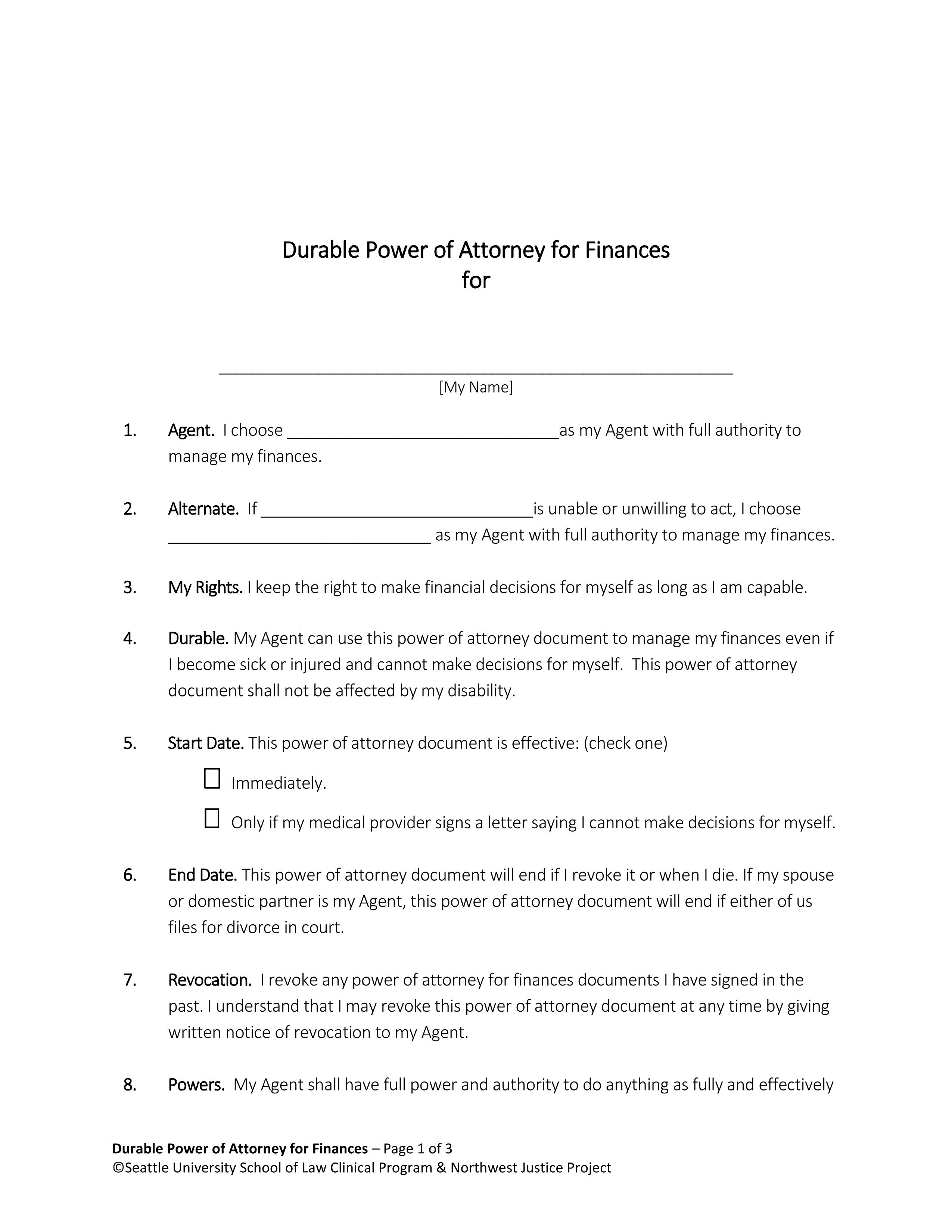

In a POA form, there are two parties involved, a principal and an agent. The principal is the one who delegated power to another person to work on his or her behalf. If a principal deemed it necessary, there could be more than one power of attorney to handle different matters.

The second party is your attorney-in-fact, also known as an agent, who receives a power of attorney. Depending upon the form, the agent can have either full power of decision-making or very limited control. An agent must agree to act entirely in the principal's best interests and preclude any conflicts of interest.

What Are the Different Types of Power of Attorney?

Depending upon the given authority, POA can be of a different type. They may also vary depending upon the time duration and their charge. Following are main four types of the POA:

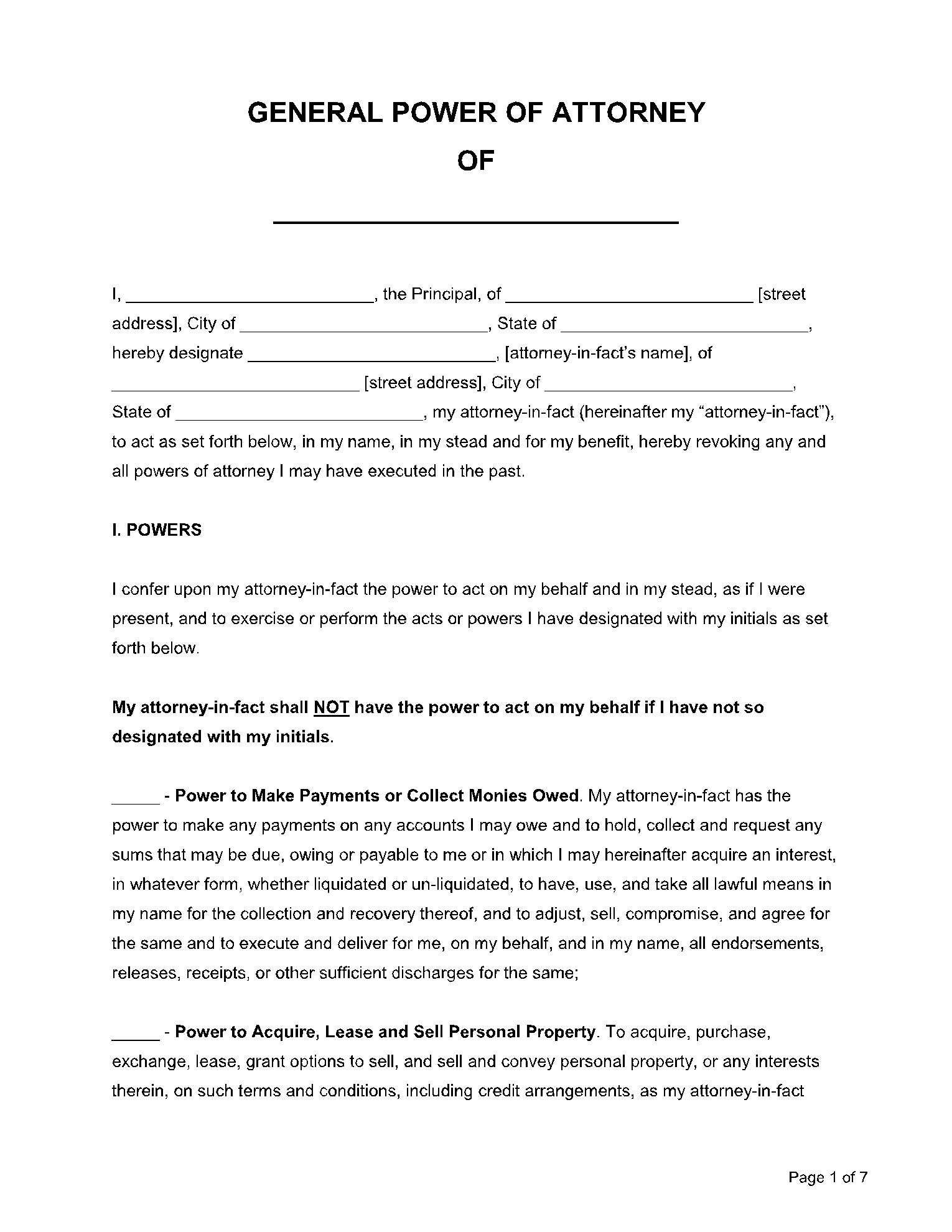

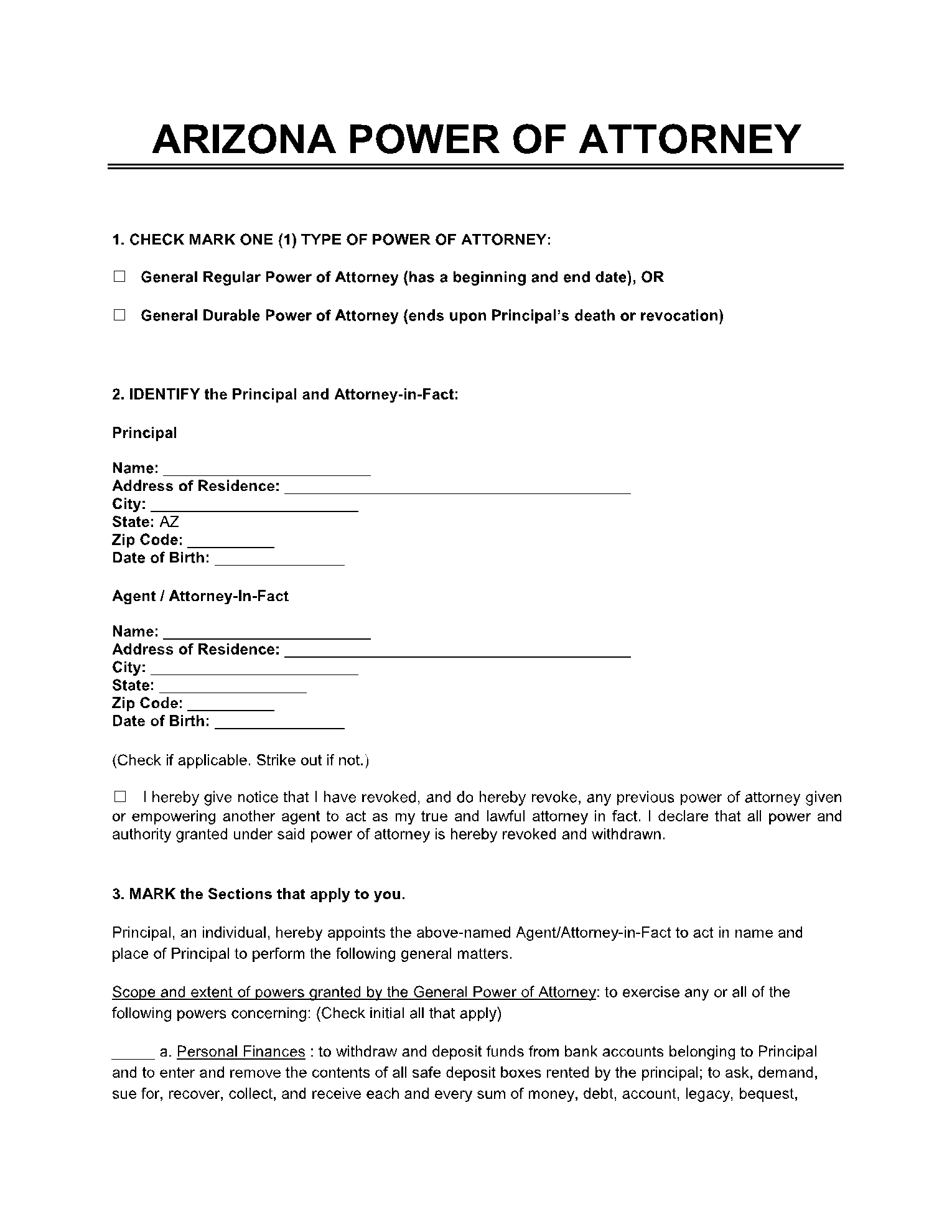

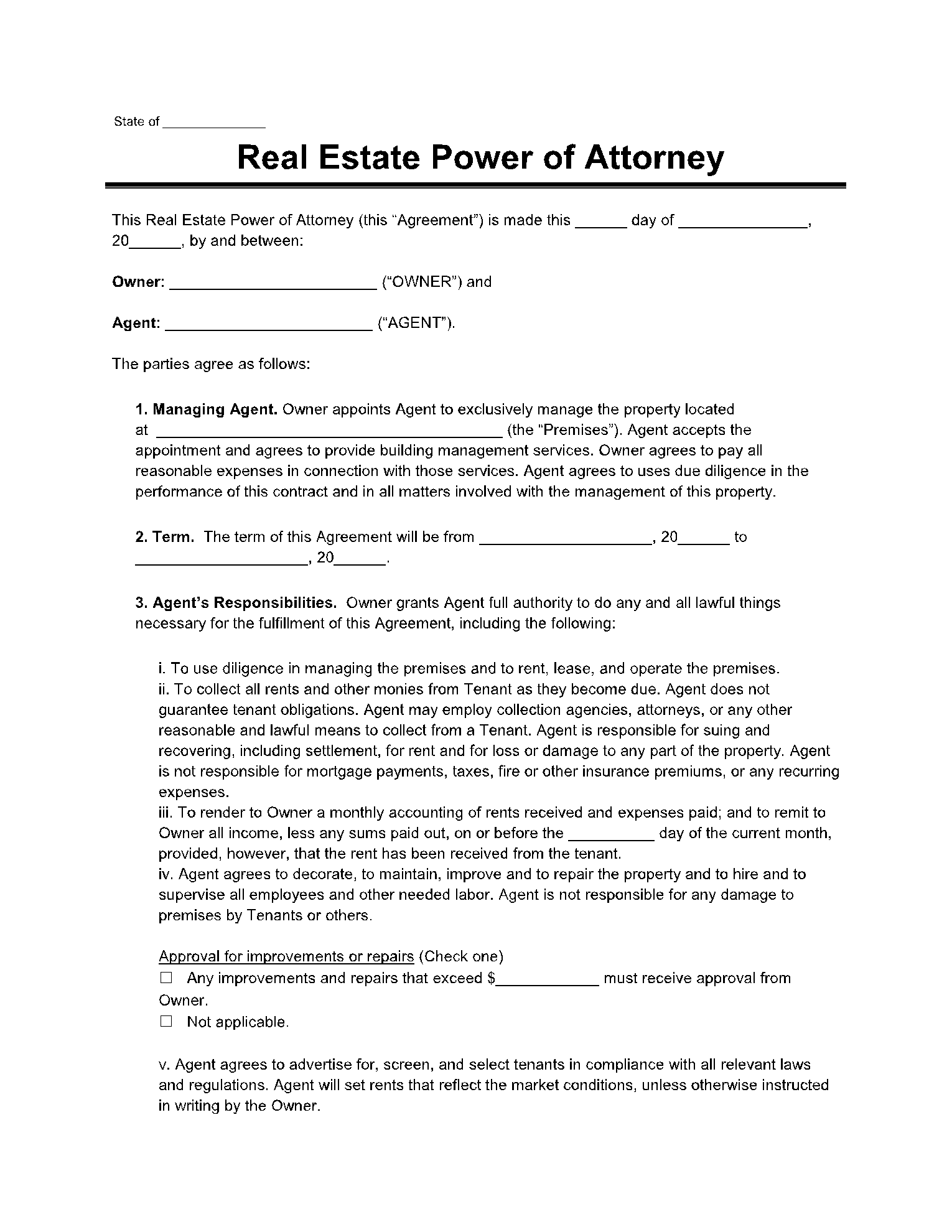

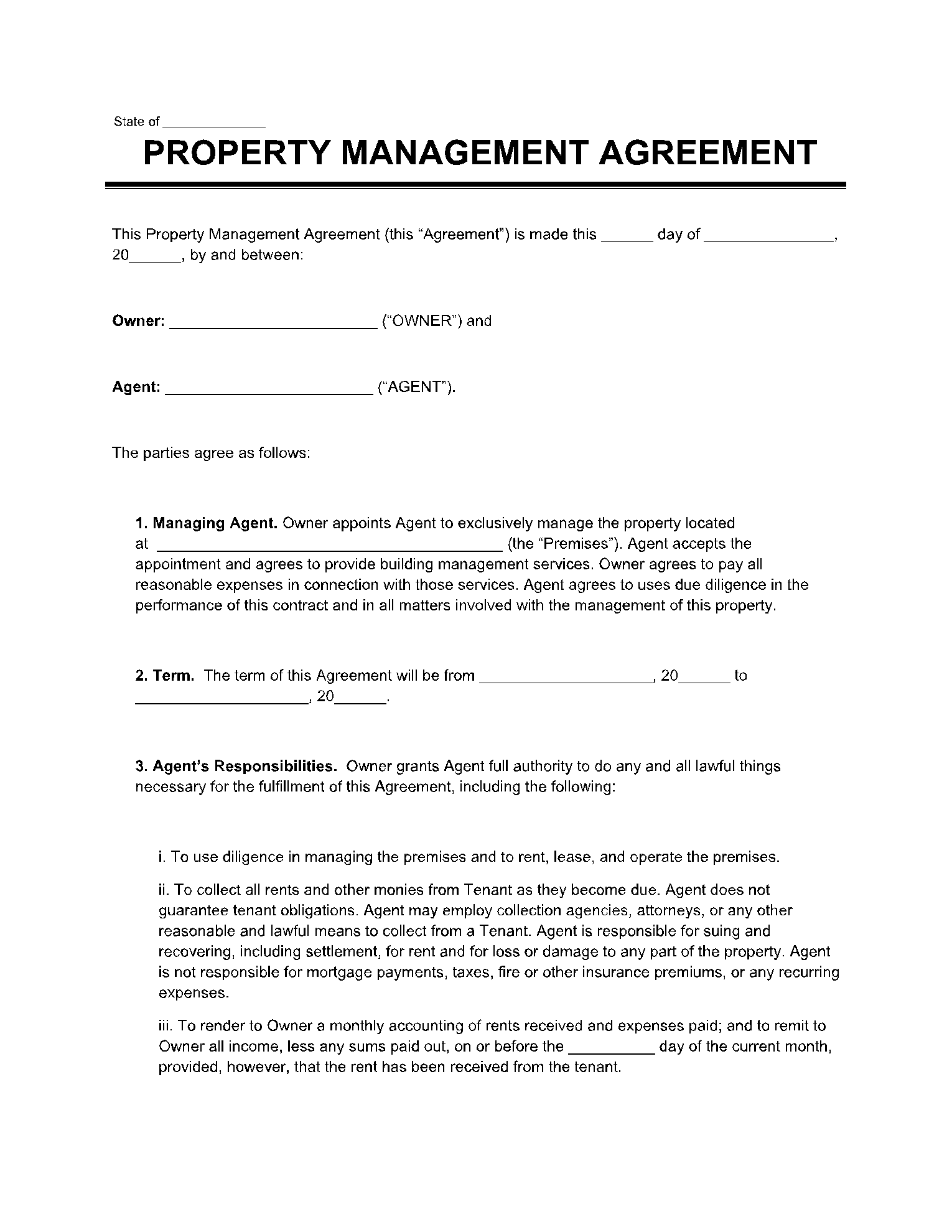

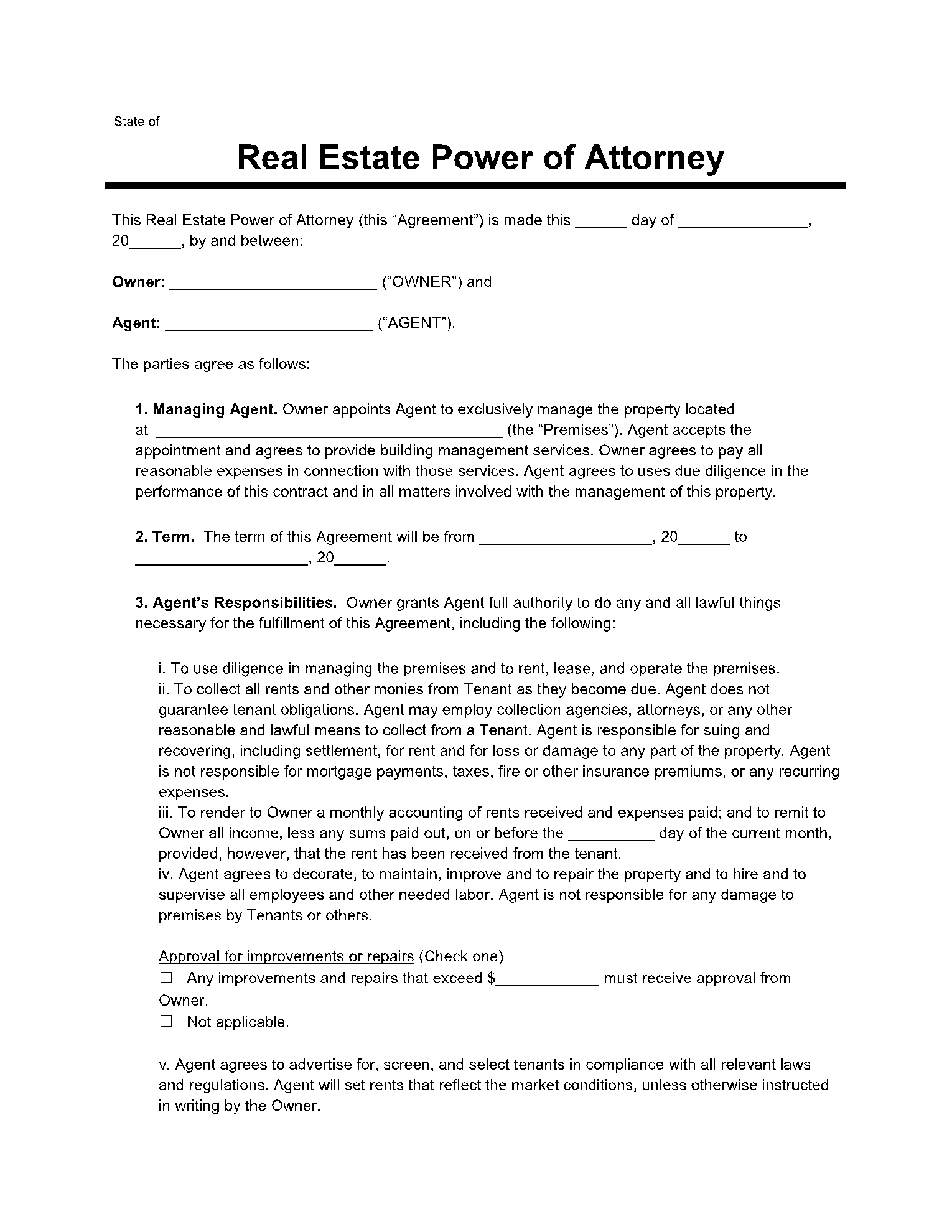

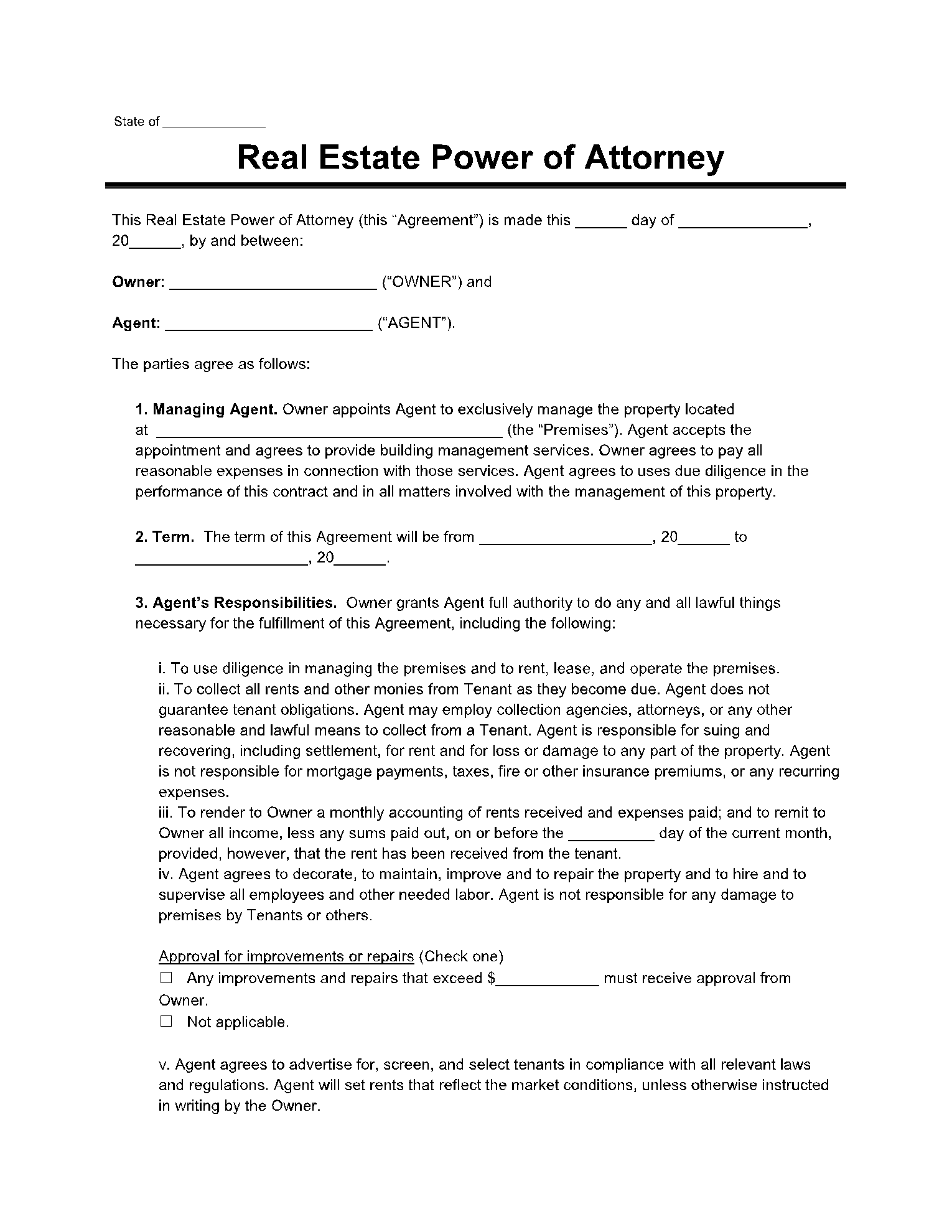

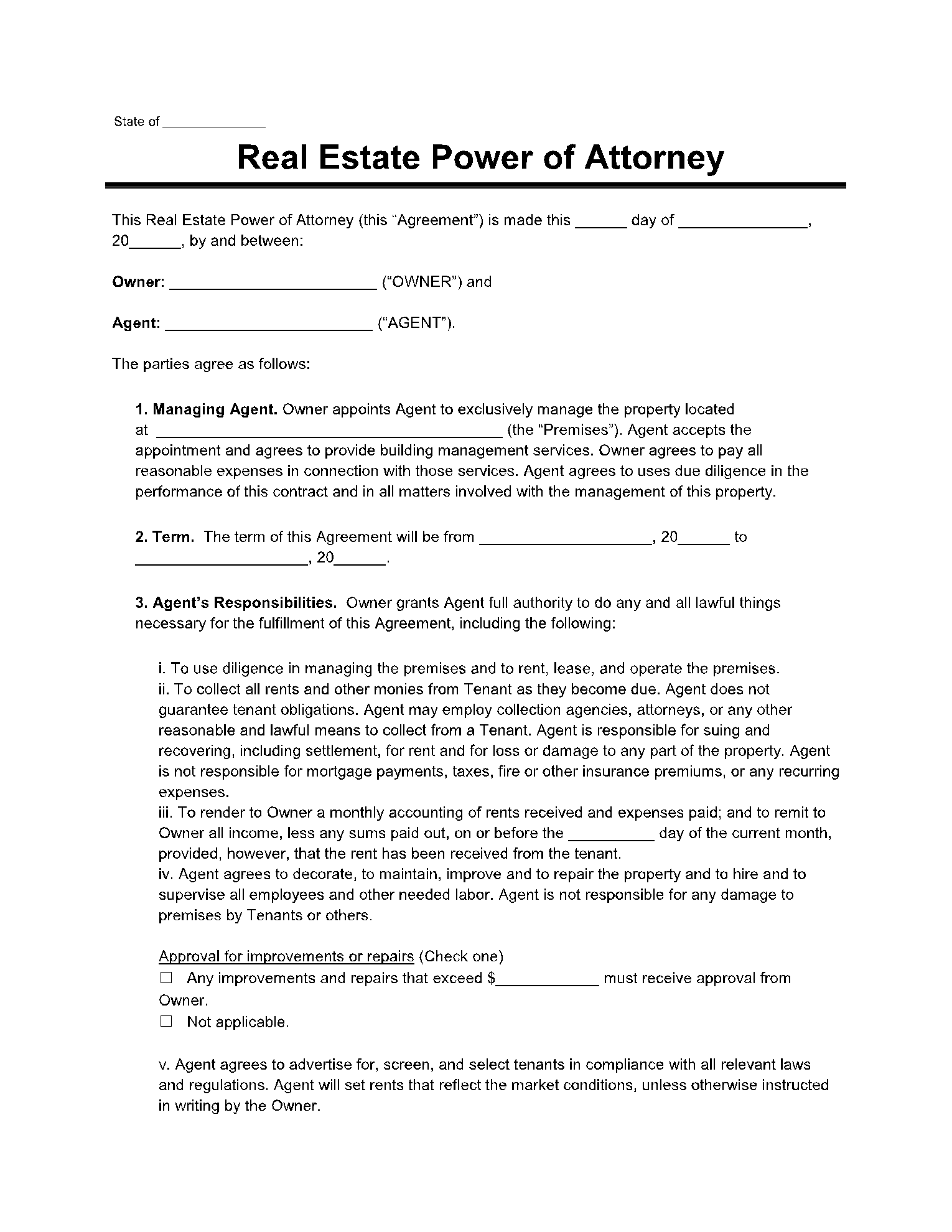

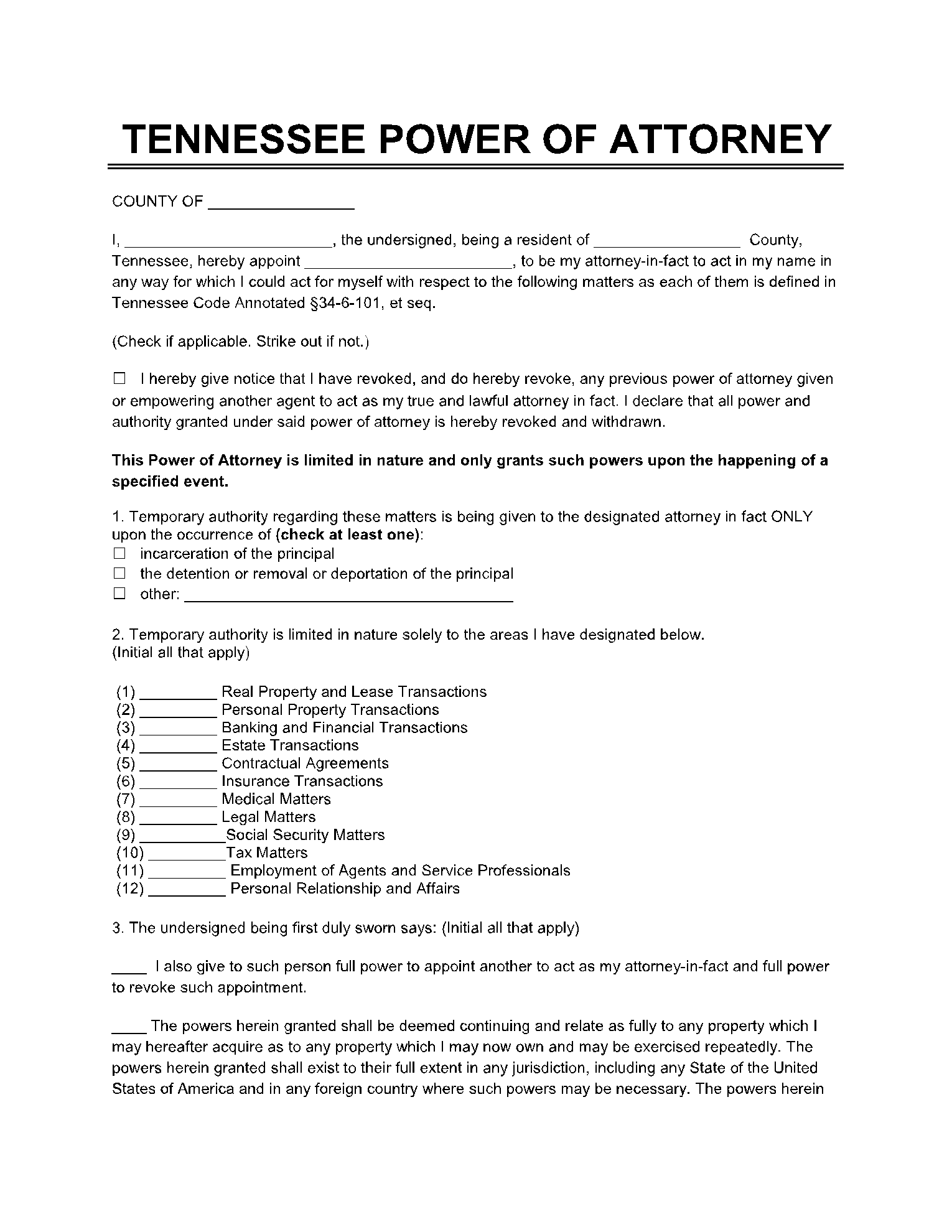

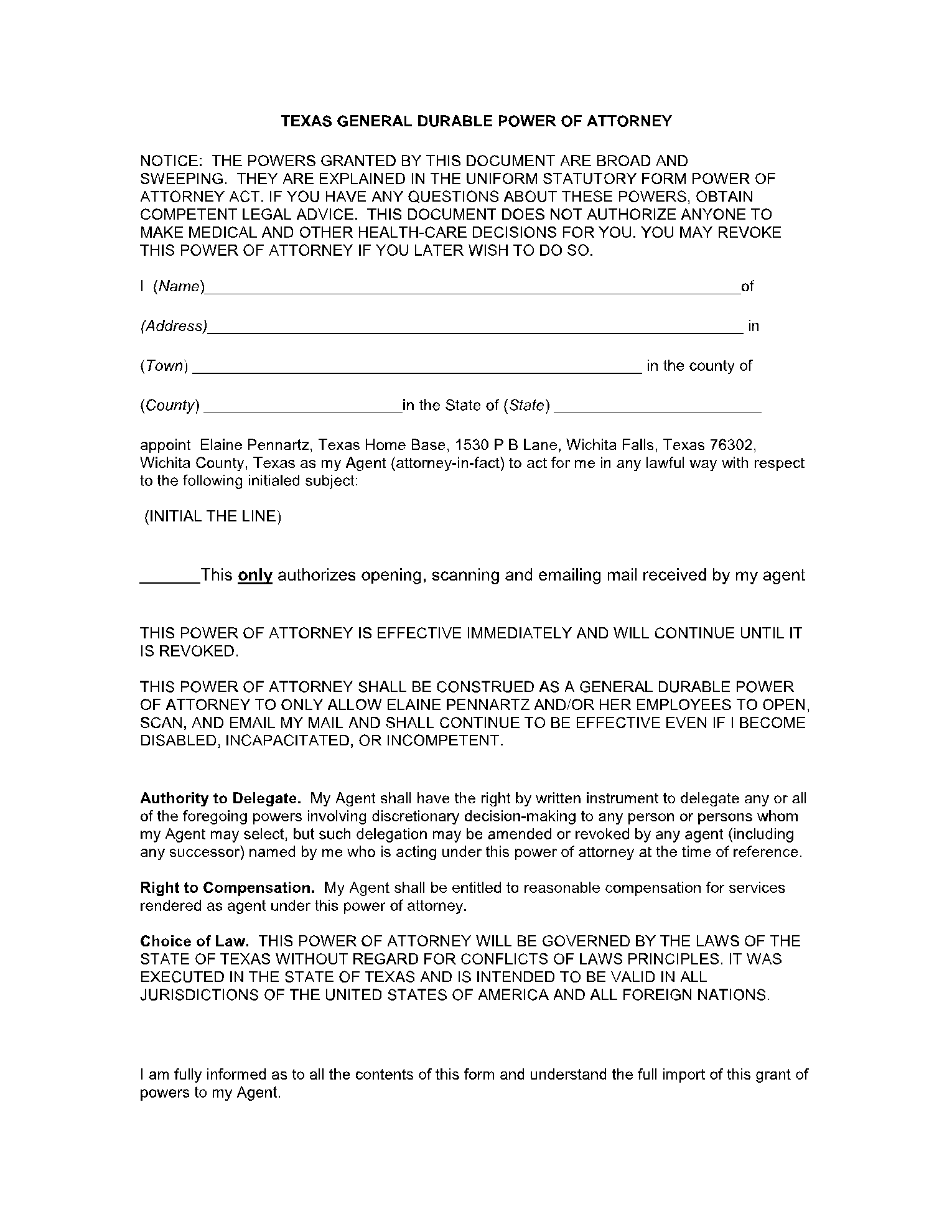

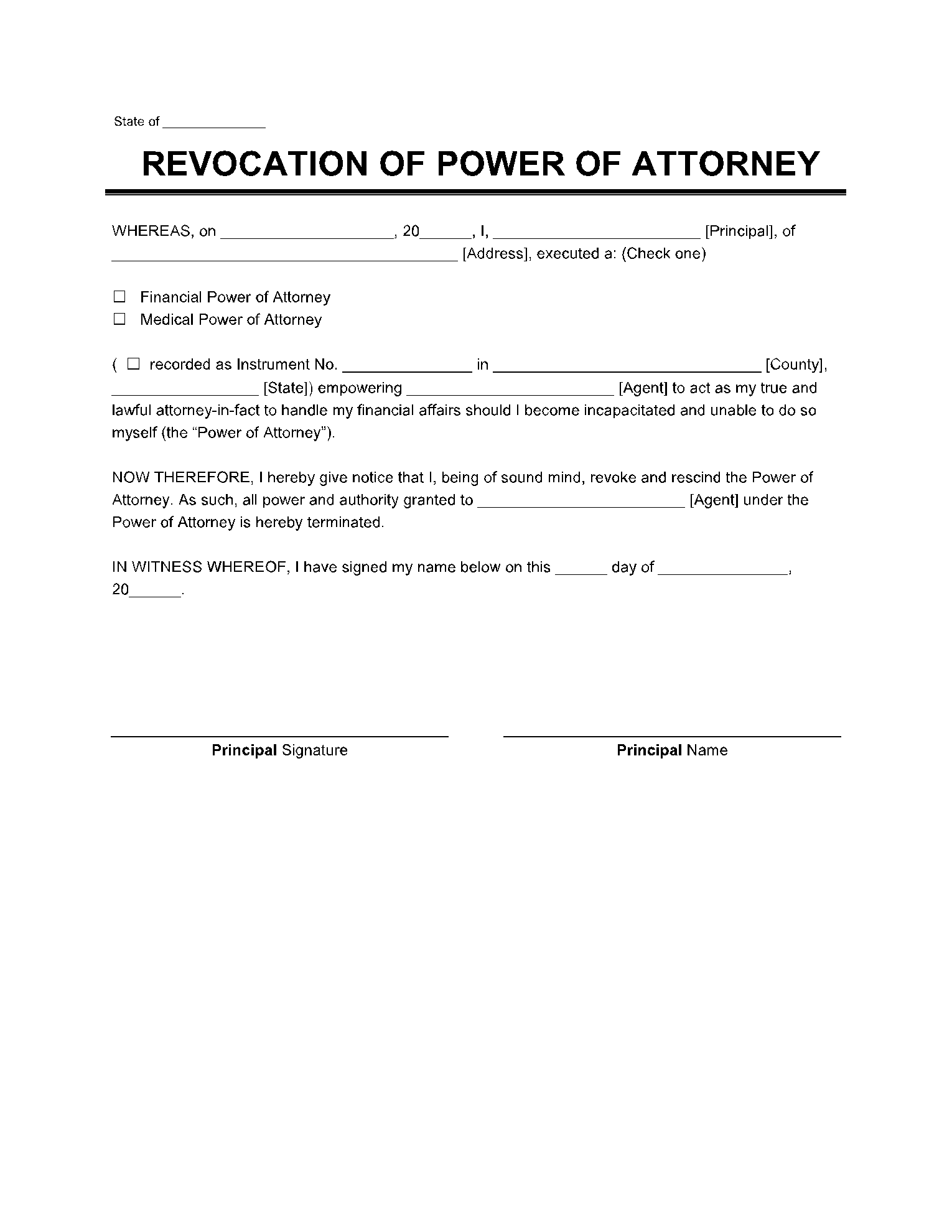

- General Power of Attorney: An agent can act on a principal behalf when he is not around to carry out his duties. This authority includes the right to handle business transactions, financing any projects, settling legal disputes, and buying or selling any real estate property. The POA form agreement comes to an end when the principal revoked the document, becomes mentally unstable, or passes away.

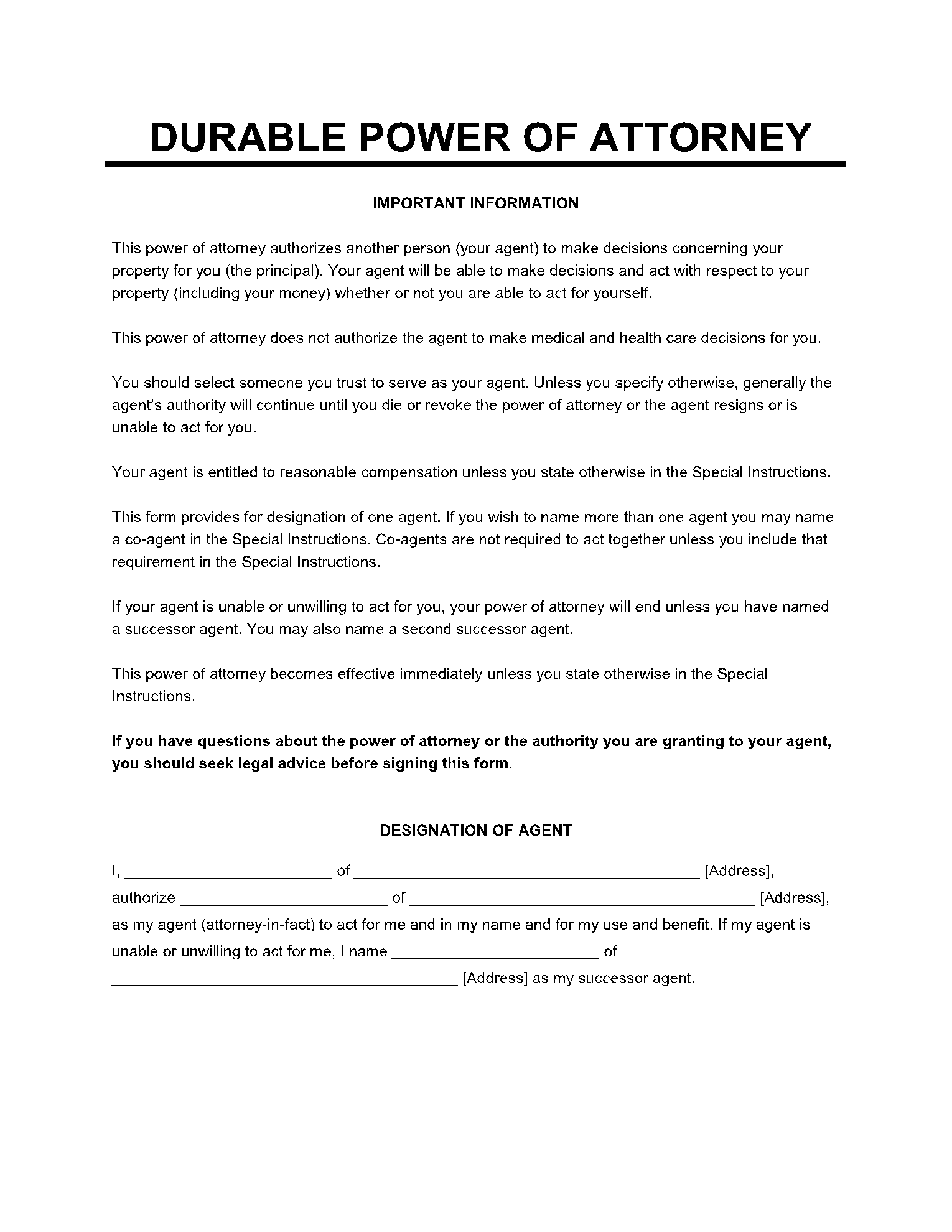

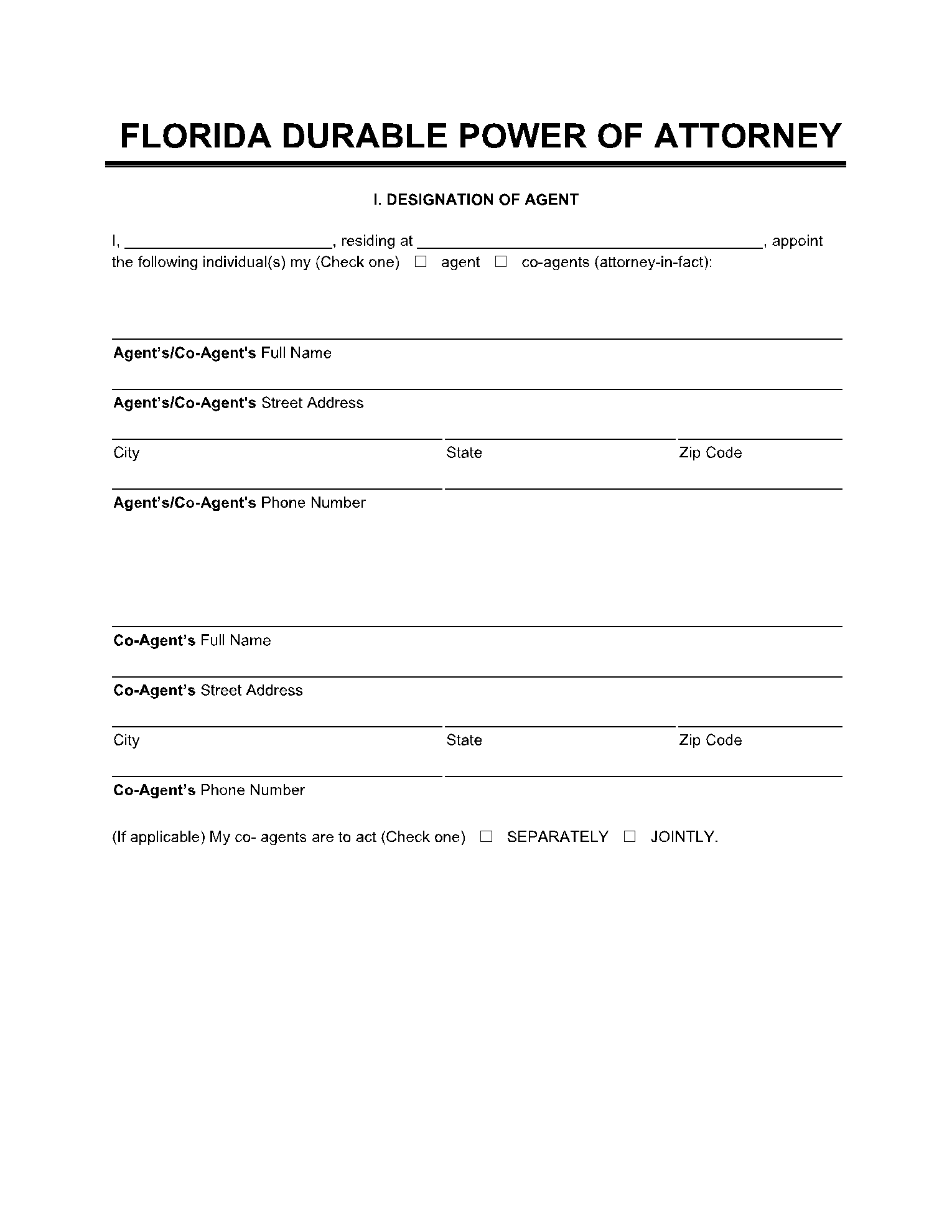

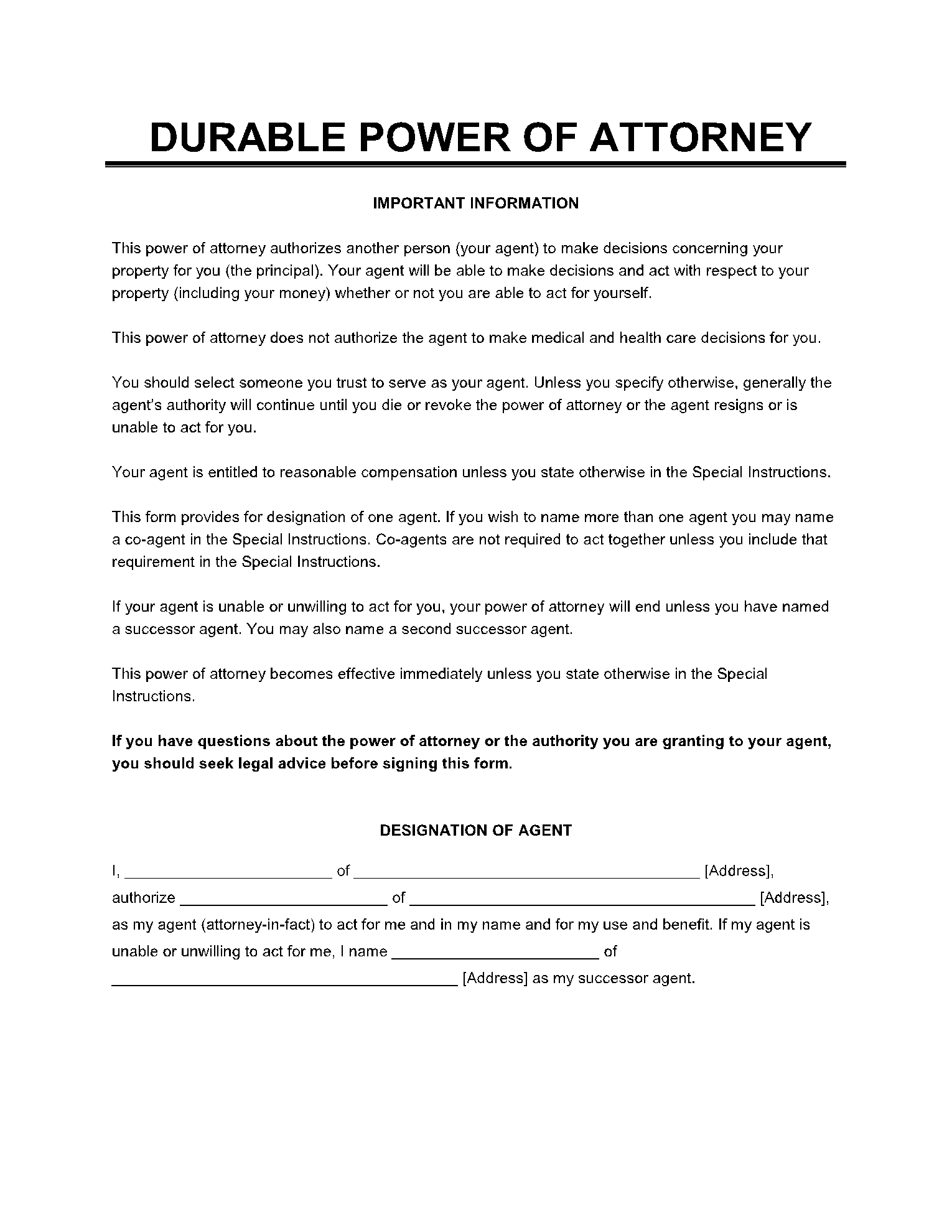

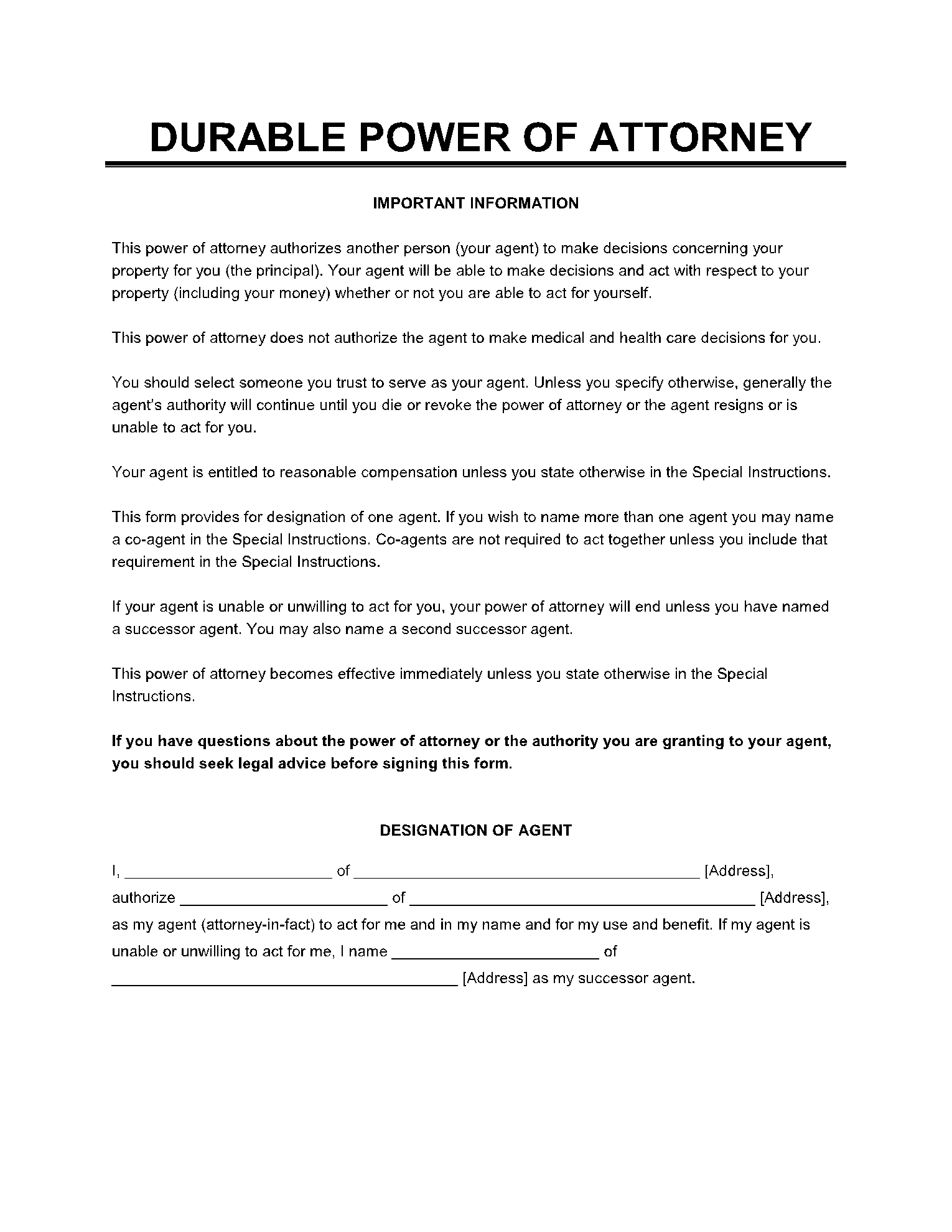

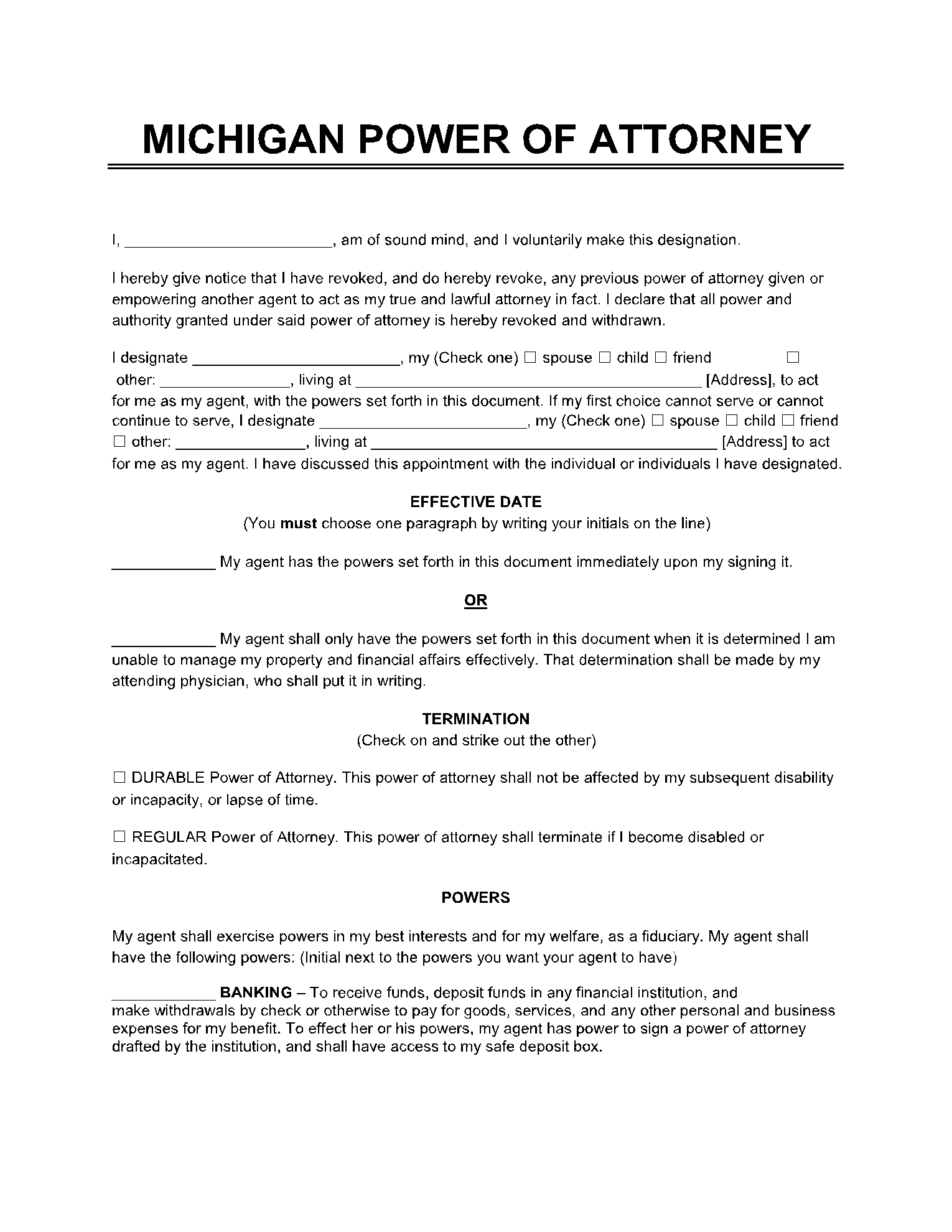

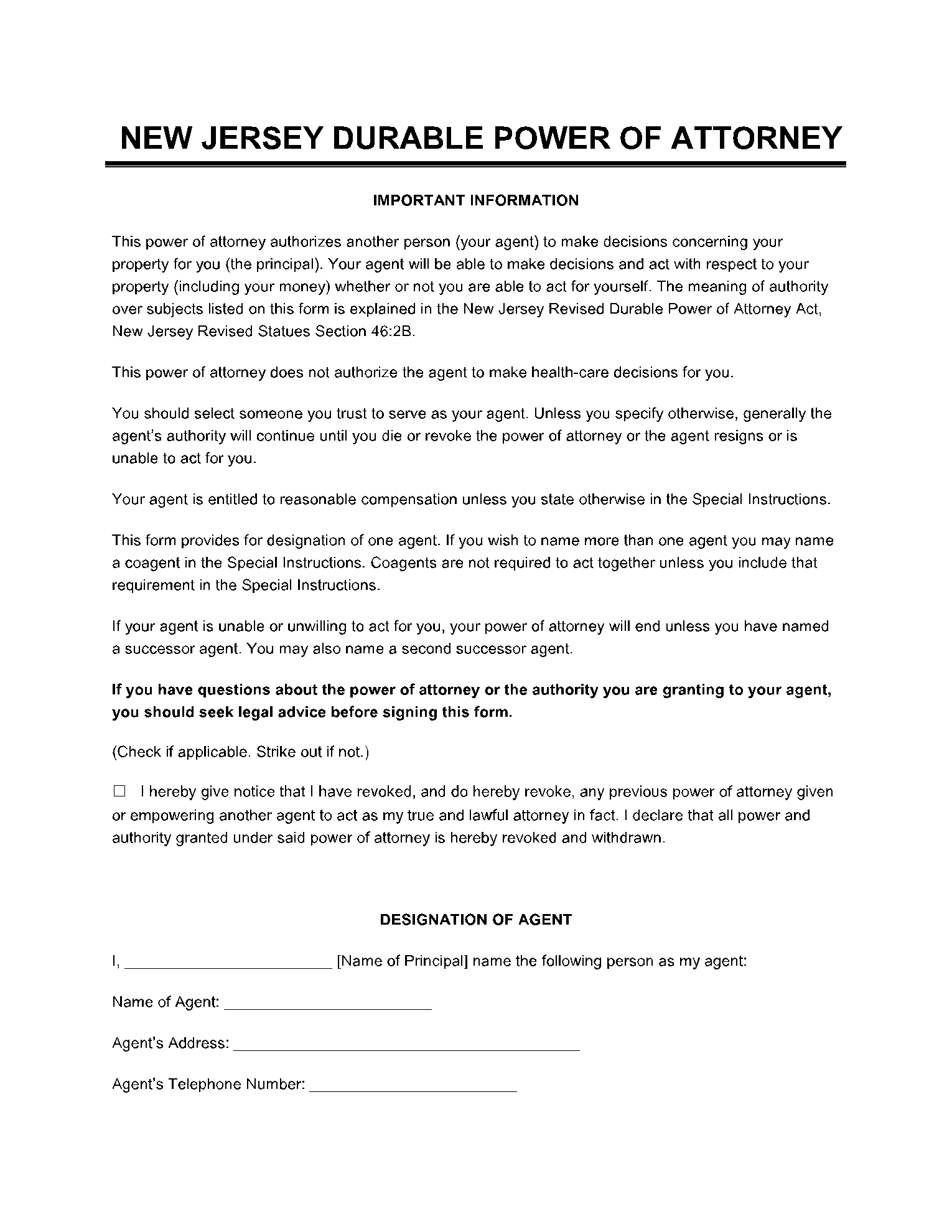

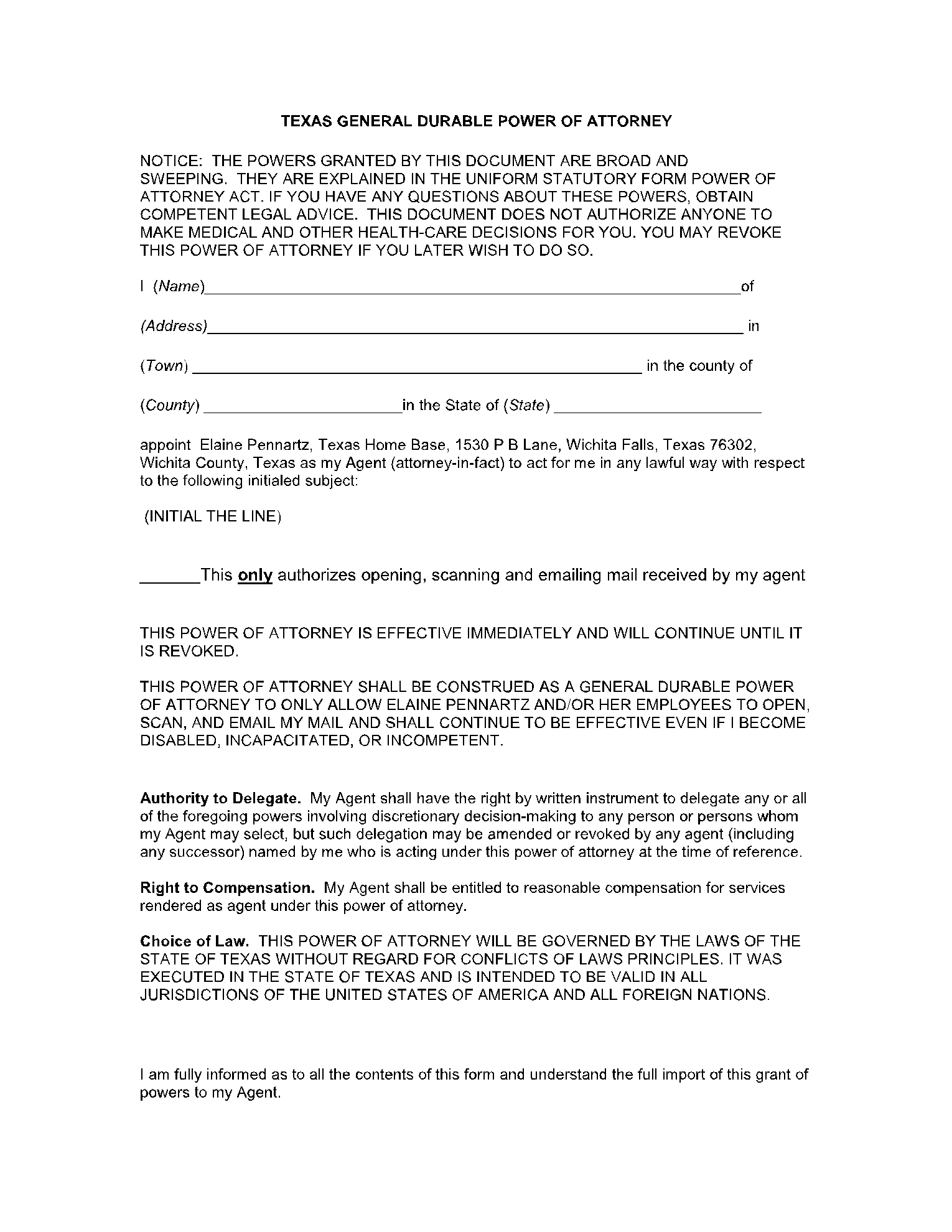

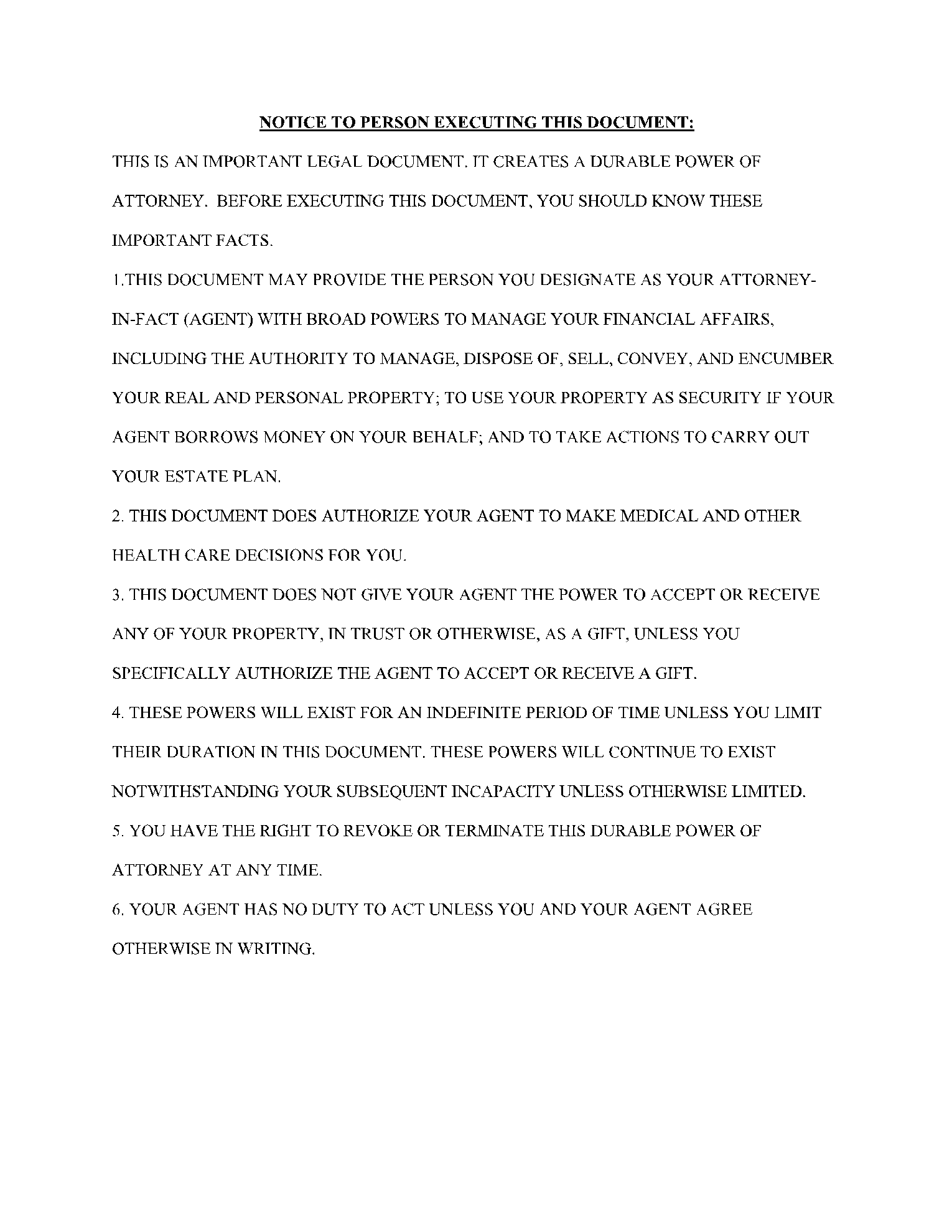

- Durable Power of Attorney: A form of power of attorney that lasts for a lifetime unless revoked. This agreement appoints someone to work on behalf of the principal, which continues to work so even though the principal becomes incapacitated.

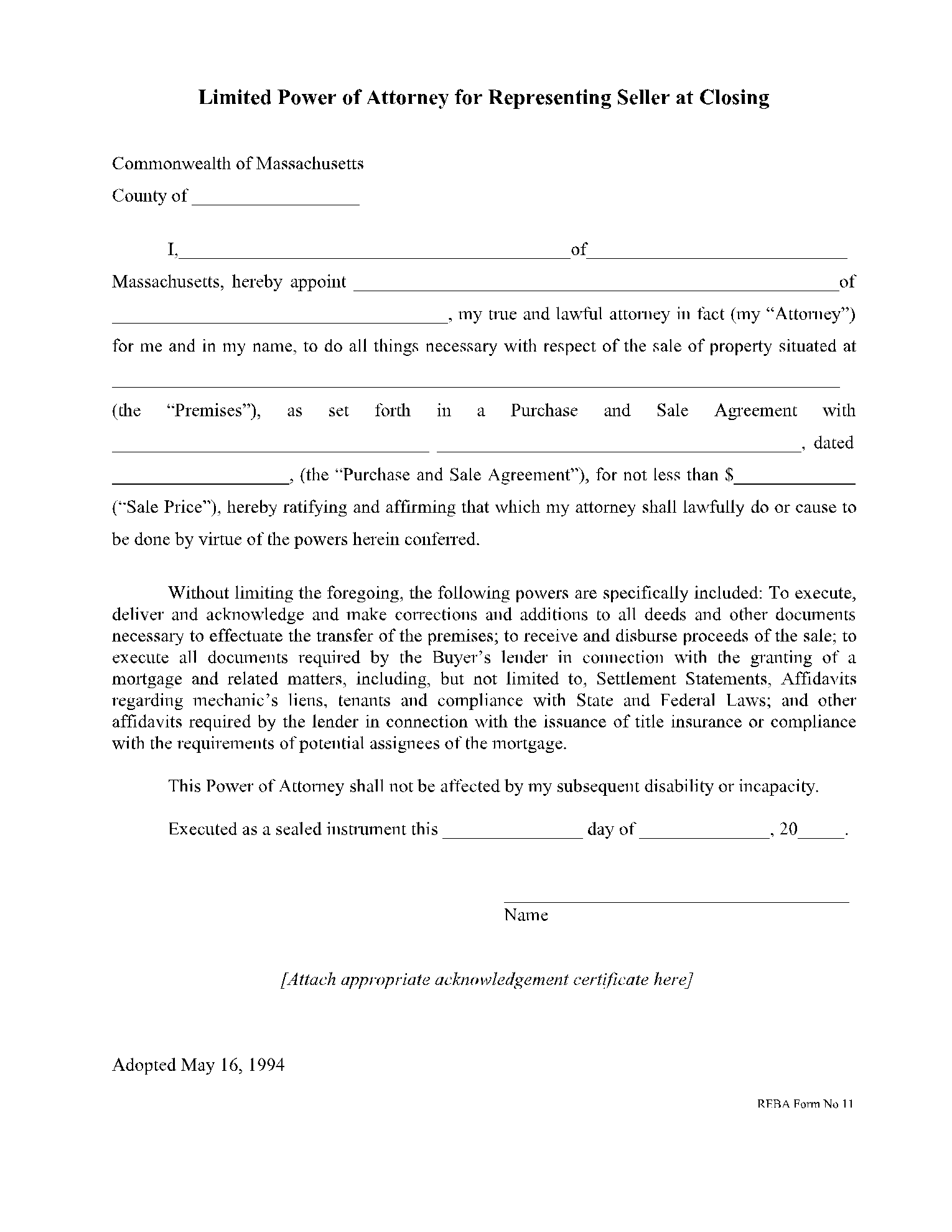

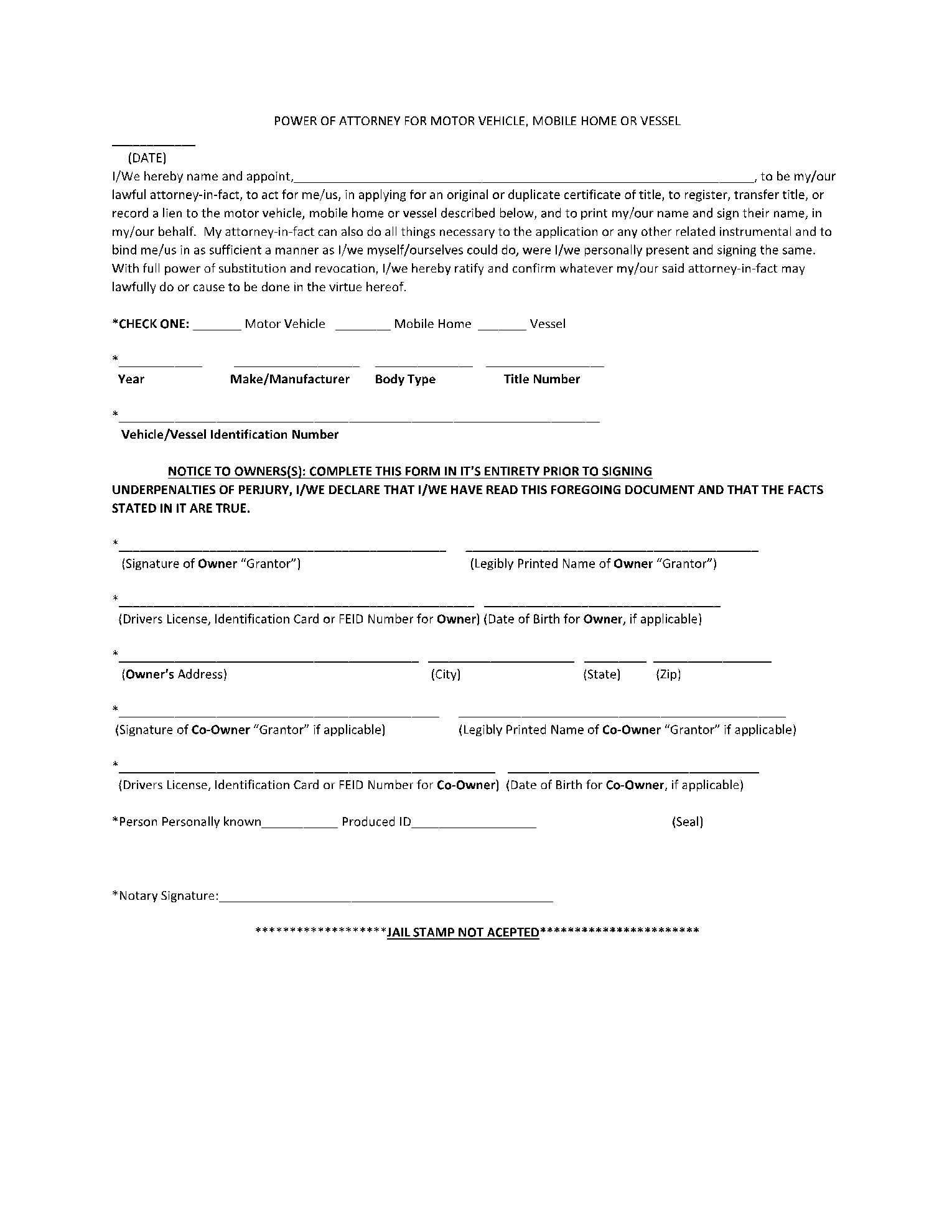

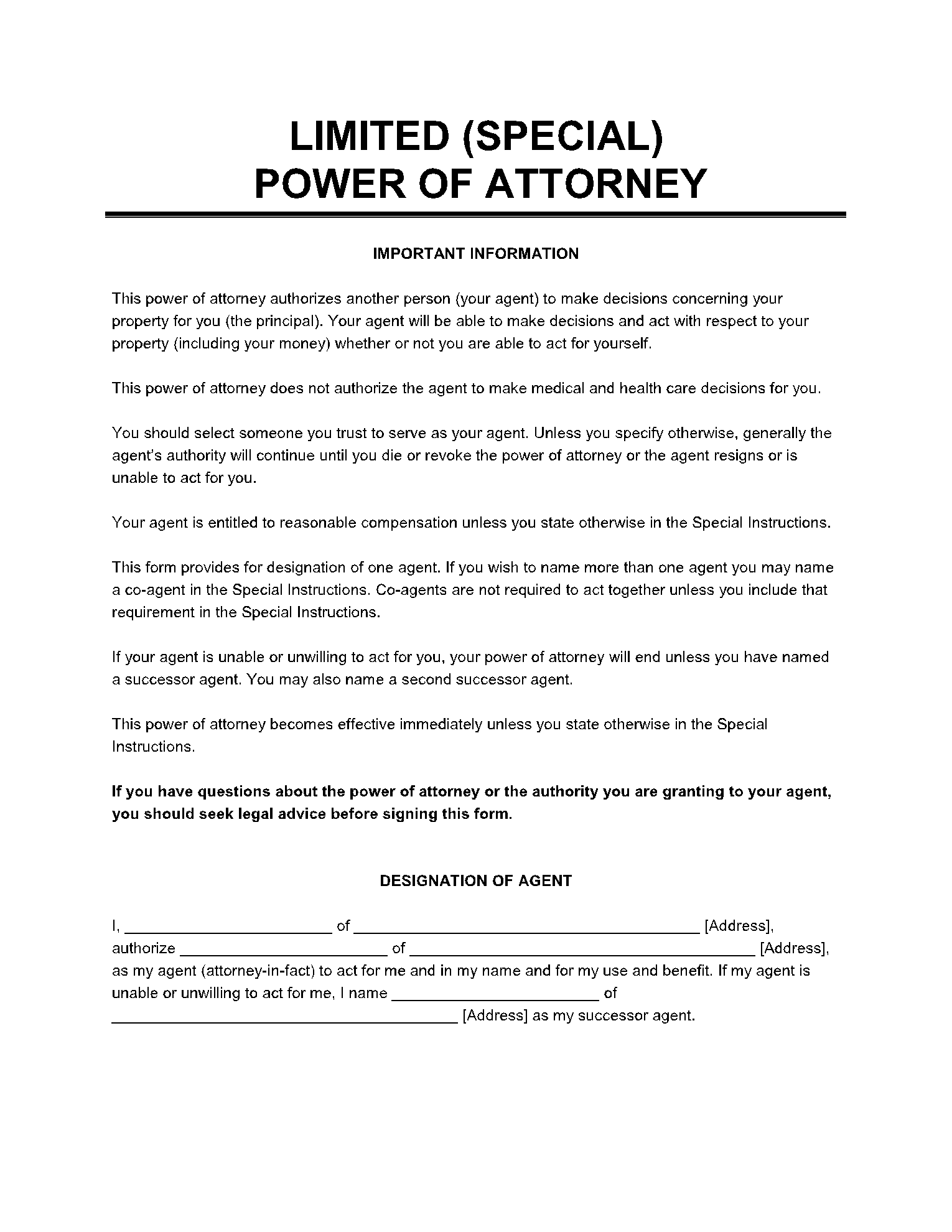

- Exclusive Power of Attorney: A legal authority that allows the agent very limited powers. A power of attorney, for example, gives the seller the right to sell a house or to handle financial transfers.

- Springing Power of Attorney: This power of attorney takes place when a particular event happens. This event can be the principal being incapacitated or expiration.

When Needs a Power of Attorney? And why?

In the ups and downs of life, you may encounter a situation when you need an accomplice to handle your matters. The accomplice will prove themselves useful in handling your cases within your absence. They may take charge of the decision-making position if you travel abroad, reach old age, or encounter similar situations.

Many people assume that a power of attorney is only used as a final resort because someone is unable to make their own choices or expires. However, that’s not the fact. Power of attorney can be used in a multitude of cases to help individuals in both regular and complicated legal, health, and financial matters.

Also, appointing a fiduciary attorney will enable you to make your representation in many jurisdictions as an advanced practitioner. This will take your burden off and helps you make winning decisions in many business and personal arenas.

What Does a Power of Attorney Form Include?

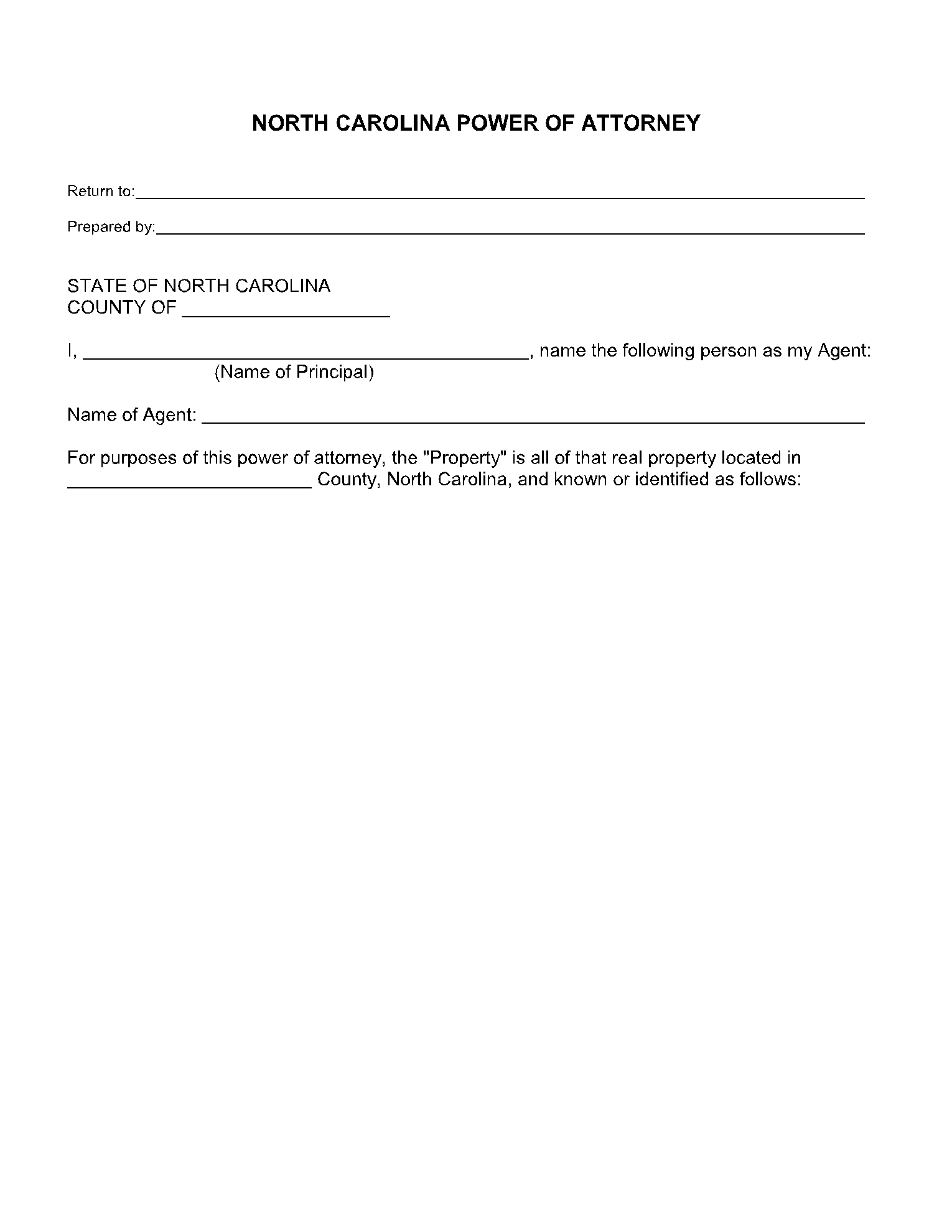

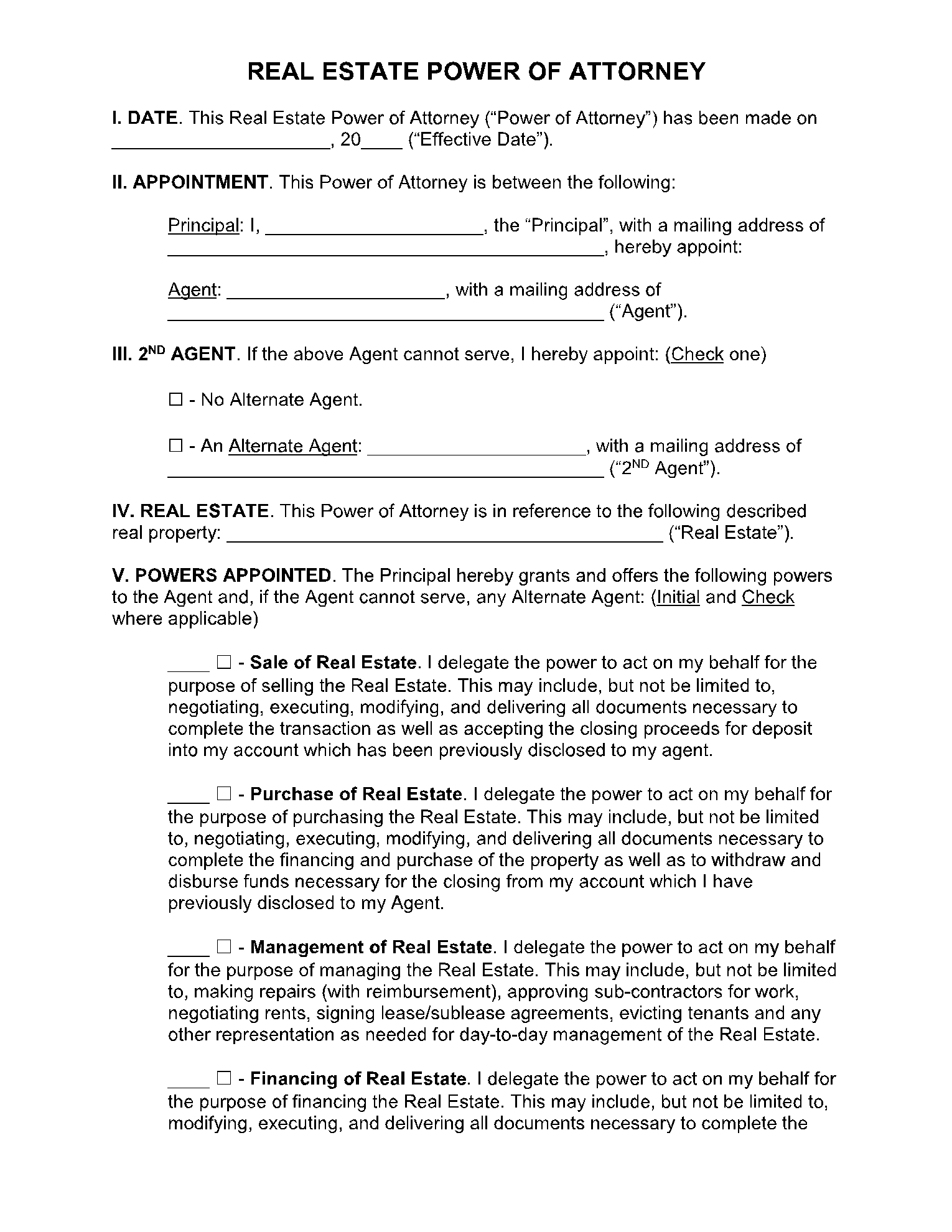

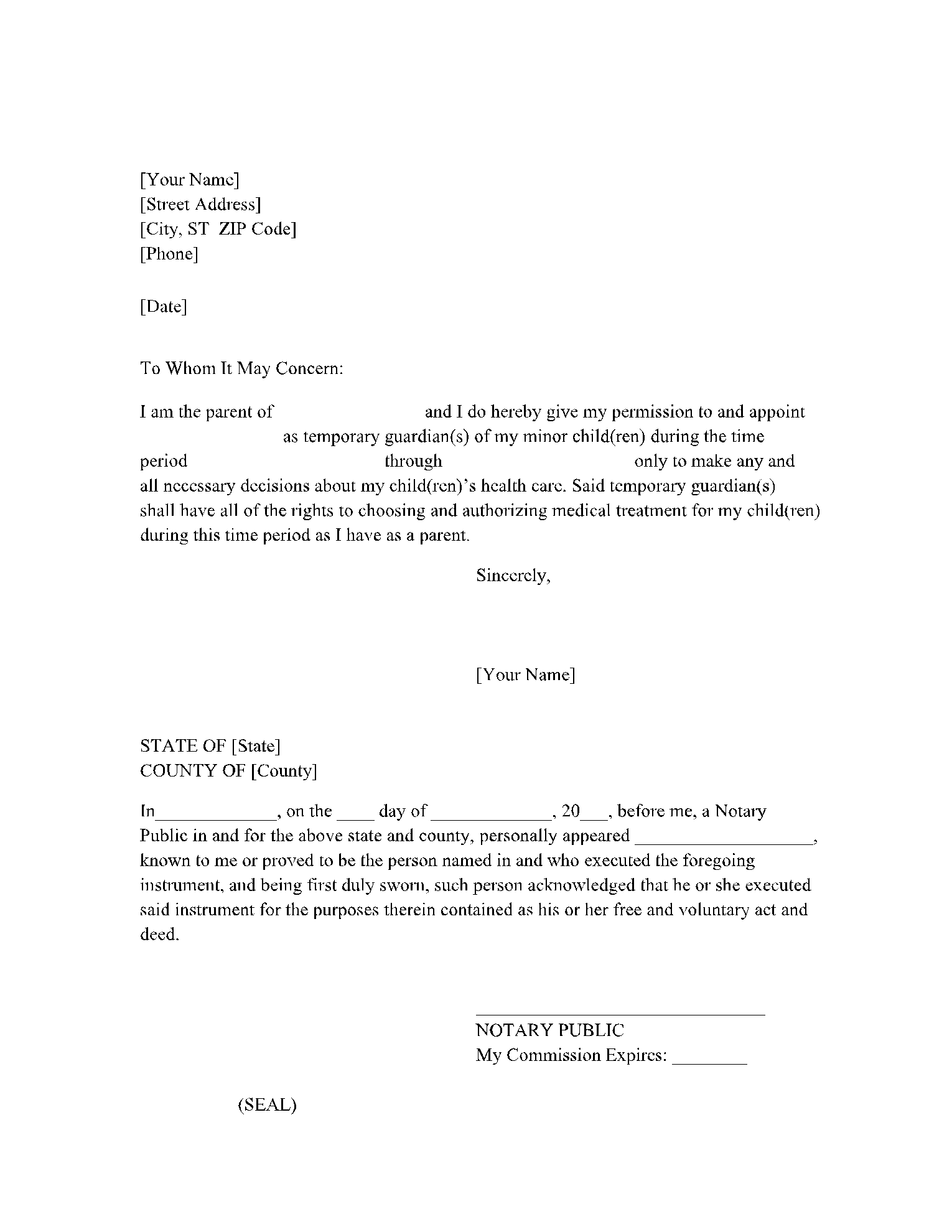

The POA form should be thoroughly drafted to ensure that no important detail is left out that may be deceptive. The form should cover all fundamental elements.

- Provide a Proper Title to the Form: Make sure to write a clear POA title to avoid any misunderstanding. For example, the POA title can be "Springing Power of Attorney when Incapacitated."

- Mention the Date on the Form: The date on which the powers were given should be written in the standard date format.

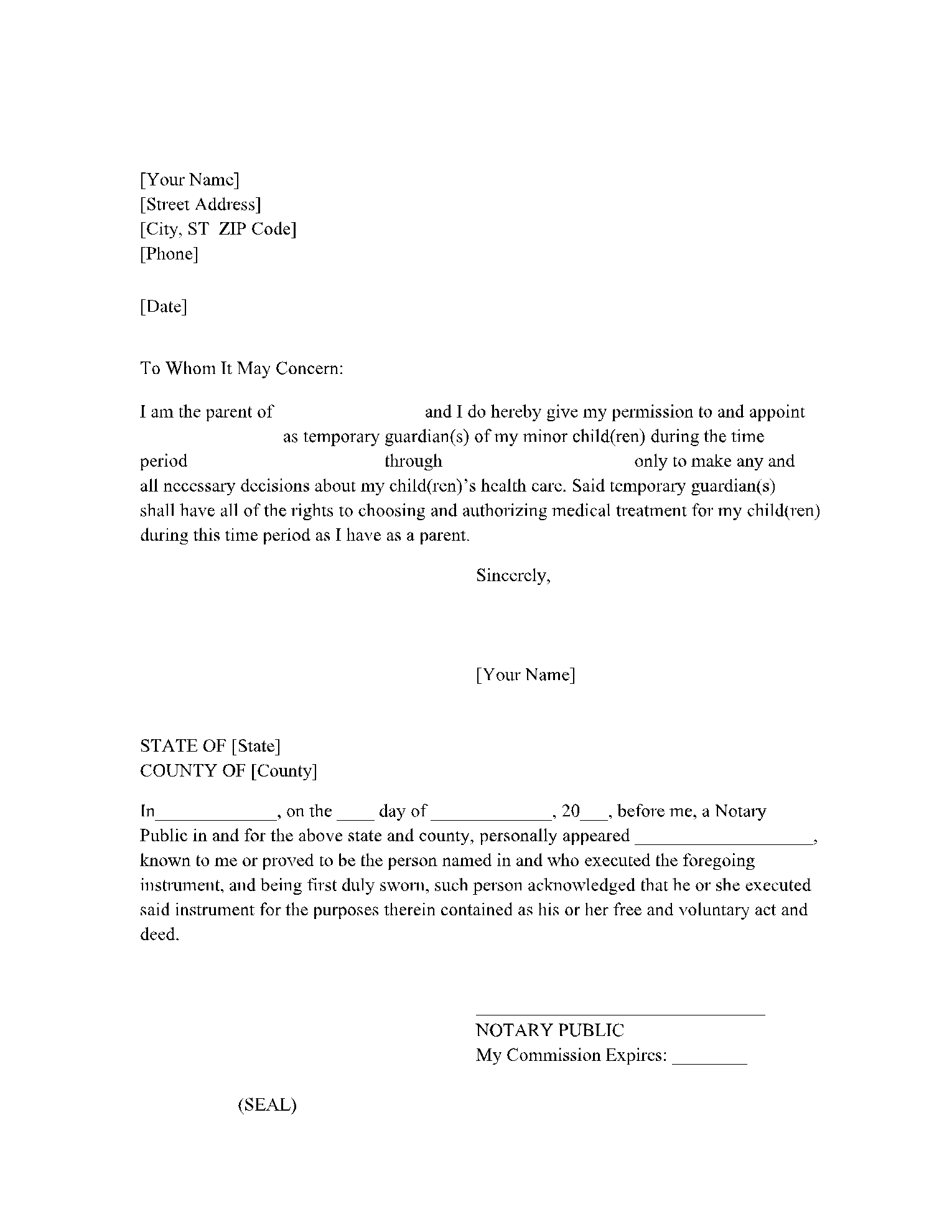

- Contact Details: It includes the principal's and agent's names, as well as their addresses and phone numbers. Anyone should be able to distinguish the two parties based on the information provided.

- Describe Specific Powers: List down all the assigned powers of the agent. For example, "Caretaker for my financial transactions" or "Take health decisions of my children," etc.

Conclusion

The importance of the power of attorney form can be comprehended over the review of this article. A power of attorney form will assist you in your presence as well as behind your back. It will help you set up an agent as your helping hand in a variety of matters.