A general power of attorney authorizes someone else to act on your behalf in financial or healthcare matters, and California has specific rules regarding the types and requirements.

Under certain conditions, the attorney form’s general power gives someone you name the authority to handle legal or financial matters on your behalf. When you make a California power of attorney form, you are referred to as the Principal, and the person you choose to act on your behalf is referred to as your attorney-in-fact or agent.

What Is a General Power of Attorney in California?

A power of attorney form California allows a Principal to name a legal representative, also known as an "Agent" or "Attorney-in-Fact," to make financial decisions on their behalf while still alive and competent. The Principal may delegate to the agent any monetary or financial decision that is legally permissible.

Unlike a durable power of attorney, however, the general does not remain valid if the Principal cannot think independently. This makes the general version popular among business partners or those willing to delegate financial decision-making authority to the Principal while the latter is competent.

How to Write a General Power of Attorney in California?

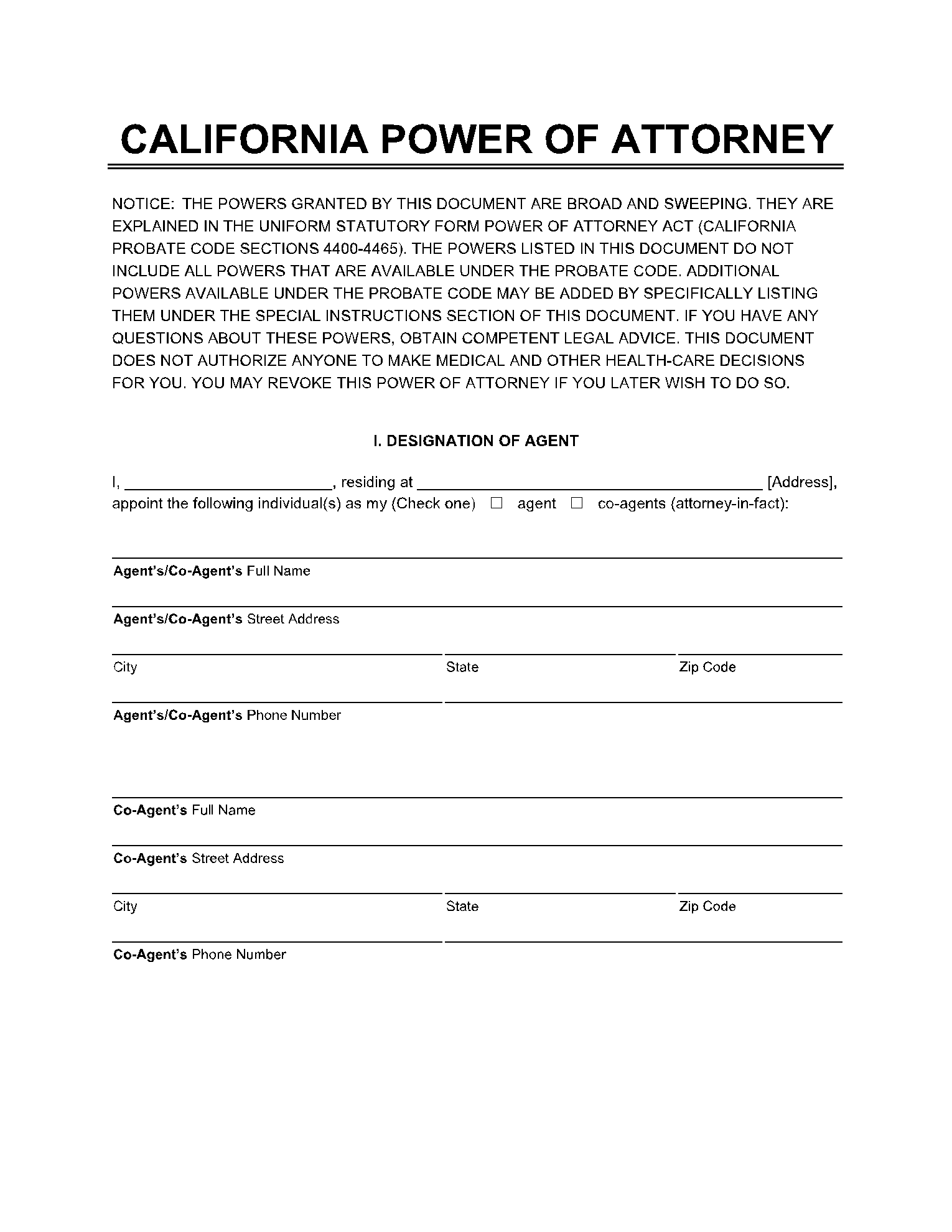

Begin by downloading the general power of attorney form pdf and reading through all of the information provided at the start of this document.

Step 1: Notify the Principal that the powers granted in this free power of attorney form California are effective immediately and remain so even if you become incapacitated, disabled, or incompetent. If you want to continue working on this document as the Principal, then provide the following information:

- Name and physical address of the Principal

- As your appointee, give the name and address of the Attorney in Fact/Agent.

Step 2: The Principal must review and initial 13 paragraphs about the Attorney in Fact/powers. If you want to give your Agent complete control over your property, scroll to the bottom of the list and initial the line giving complete control.

With the general power of attorney form, your agent is not allowed to make any health decisions. California power of attorney form is therefore subject to revocation at any time.

- Real-estate deals

- Transactions involving tangible personal property

- Transactions of stocks and bonds

- Transactions in commodities and options

- Transactions involving banks and other financial institutions

- Transactions relating to business operations

- Transactions involving insurance and annuities

- Transactions involving estates, trusts, and other beneficiaries

- Litigation and claims

- Personal and familial upkeep

- Military service or benefits from Social Security, Medicare, Medicaid, or other government programs

- Transactions involving retirement plans

- Concerns about taxes

Step 3: Special Instructions

You can restrict or expand your Attorney in Fact/powers Agent's on the lines provided.

Step 4: Successor Agent

You may add a successor agent in the lines given if your initial agent is unable or unwilling to carry out your instructions and powers. Provide the name and address of your chosen successor agent, who will only perform service if the initial agent cannot.

Step 5: Signatures

You must keep a notary public’s services before submitting signatures to the California power of attorney form. Read the paragraphs above your signature line once you've appeared before a notary. If you agree, then provide the document's date, sign it and enter the Social Security Number.

Step 6: Notarization

The notary will then complete their commission information and affix their state seal to the document, acknowledging its completion and signatures.

Step 7: Agent Acknowledgement

Your agent will read the paragraph and provide the following:

- Your appointed agent's typed or printed name

- Signature of the Agent

Step 8: Statement of Preparation

Whether you or someone else prepared the document on your behalf, you or they must recognize who did so by providing:

- Their name typed or printed

- Their signature

Make copies of the general power of attorney to send to those listed in it as well as any financial institution with interest in your estate after you've completed it. You must inform all parties involved in the form and the financial institutions you contacted before writing if you decide to revoke this document.

When Do You Need a Power of Attorney?

If any of the following apply to you, you should consider obtaining a general power of attorney:

- You frequently travel outside of the country.

- You work in a potentially dangerous environment and have been diagnosed with a severe illness.

- You have a company or property that you'd like to keep running if you could not do so.

- If you were to become incapacitated, you would have to fend for your children.

- You want someone to be in charge of your affairs.

- You have rules for how you run your business, your property, or your life, and you want to make sure that they are followed.

- You're getting close to retirement age and want to choose someone to represent you.

Final thoughts

As defined by the state, a California power of attorney form acts on behalf of the Principal in any matter. A California power of attorney form may give the agent authority to handle things like bank accounts, signing checks, selling property and assets like stocks, filing taxes, and so on.

A principal must be 18 years old or older to make a California power of attorney form. The Principal must be legally capable of entering into a contract. The Principal, two witnesses, or a notary must all sign a general power of attorney in California.